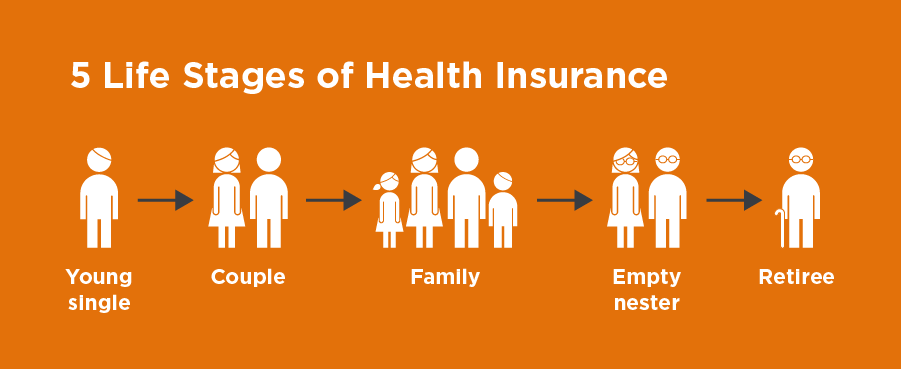

The 5 Life Stages of Private Health Insurance

The 5 Life Stages of Private Health Insurance

Compare Health Insurance Policies

Save time and effort by comparing a range of Australia’s health funds with iSelect

What life stage are you in?

1. Young single

2. Couple

3. Family

4. Empty nester

5. Retiree

What about Lifetime Healthcare Loading?

Where can I find and compare Health Insurance?

Broadly speaking, you can take out Private Health Cover for Hospital treatments, Extras, or both. Hospital-only cover comes in Basic, Bronze, Silver and Gold tiers, which are standardised across providers. For Extras Cover, providers have more flexibility around what they offer. Different levels of Hospital and Extras Cover will be appropriate for the different phases of life you enter.

What life stage are you in?

To think through what you want from your Health Insurance, consider where you fit into these five life stages:

- Young single

- Couple

- Family

- Empty nester

- Retiree

Of course, these stages won’t reflect everyone’s life journey. And there’s no ‘correct’ way to be in any of these stages. (If you’re an old single, a young retiree, or an empty nester thinking about getting braces, we support you.)

1. Young Single

Maybe you’ve moved out of home and you’re starting to figure out your budget (eep!). Maybe you’re sitting pretty with your folks but you’ve aged out of their Family Policy. Either way, as a young single, you might be considering getting Health Insurance for the first time.

Even if you’re in good health, Basic Hospital Cover can be a good choice at this life stage. On top of a Basic Policy, you might be interested in Extras like dental, optical, physiotherapy and chiropractic, or remedial massage.

Even if you don’t think you need Private Health Insurance, at this age, there are government financial incentives to encourage you to take out a policy. These include a rebate on your policy that depends on your income level, and getting to skip paying Lifetime Healthcare Cover (LHC) Loading later in life.

2. Couple

All loved up? Congrats! If you’re in a serious relationship, you might be doing some kind of planning for a joint future, and Health Insurance could be a part of that.

Couples Policies are designed to cover two people under one policy, with the same level of coverage for both people. Taking out a couples policy could make it easier to pay your premiums and keep records. If it’s important to you to tailor your coverage individually, keeping two separate singles policies might be a better option.

If having children is on the cards, you might want to look into a Couples Policy that includes benefits for reproductive health, pregnancy and childbirth.

3. Family

A family can take a lot of different shapes – but for the purpose of Health Insurance, it’s one or two parents plus their dependent children. Starting or growing a family is a rewarding life stage, but it also comes with a unique set of challenges and needs, particularly around Private Health Cover. If you’re a parent, you might want to be covered for pregnancy and childbirth, if your children get sick, or if a family member develops a chronic illness.

Having children can mean having less flexibility in other areas of life, so you might appreciate the greater flexibility afforded by Private Health Insurance. Private Cover can mean more choice around doctors, plus access to private hospital rooms and avoiding public waiting lists for surgeries.

4. Empty nester

House feeling a little empty? Or have you been waiting for years to turn the kids’ room into a tiki bar? Once your kids have grown up and are starting to head out on their own, you’ve reached the empty nester stage. In this older age bracket, people are more likely to need cataract surgery and are at higher risk of cardiovascular disease,1Australian Institute of Health and Welfare – Older Australians so a higher level of Private Health Cover is usually appropriate. At this stage, it might be a good idea to consider the Silver or Gold tiers of Health Cover, both of which include things like implantation of hearing devices, diabetes management, heart and vascular system and more.

If you’d like to keep your adult children covered by your Health Insurance after they’ve moved out, your Health Fund might allow them to stay on your Family Plan until age 31 (additional fees and conditions can apply).2Department of Health and Aged Care – Private health insurance reforms

5. Retiree

Once your working years are over and you’re settling into retirement, you’ll finally have time to write that book! You might also start to need more expensive medical treatments and medications. Keeping Private Health Insurance through this phase of life could help you maintain your quality of life and longevity. And although planning for end of life might feel uncomfortable, having a level of Insurance that includes unrestricted coverage for palliative care might be something to consider.

If you’re 65 years or older, you can also get a higher rebate on your Private Health Insurance. The rebates vary depending on income and age but, as an example, a single 66-year-old earning below $93,000 could get a 28.71% rebate.3Private Healthcare Australia – Australian Government Private Health Insurance Rebate A couple earning below $186,000 where the oldest person is 71 could get a 32.812% rebate.4As above

What about Lifetime Healthcare Loading?

Lifetime Health Cover (LHC) Loading is designed to incentivise people to take out appropriate levels of hospital cover earlier on. It adds an extra 2% onto your Health Insurance premium (up to a maximum of 70%) for every year you don’t have Private Health Insurance from the first financial year after you turn 31.5Australian Taxation Office – Lifetime health cover This can really add up and make your health insurance pretty pricey down the track!

So if you take out Hospital Cover when you’re 31, you won’t pay the LHC at all. But if you take out Hospital Cover for the first time when you’re 40, you might be paying 20% more on your premiums than if you’d taken it out when you were 31.6As above

But if you’re in it for the long haul, there’s a benefit. Once you have paid LHC loading for 10 years of continuous hospital cover, the loading will be removed!

Where can I find and compare Health Insurance?

Need help finding Health Insurance for your stage in life? We’re here to help. Save time and effort by comparing a range of Australia’s Health Funds with iSelect*, either online or by phoning 1800 784 772.

WE’RE HERE TO HELP

Need help with health insurance?

We can help you find a suitbable product for your needs

Health Insurance & Tax

Tax Implications on Health Insurance

About the Medicare Levy Surcharge

About the Life Time Health Cover Loading

Government Rebate & Means Testing

.svg)