Gold Cover: Understanding the Highest Health Policy Tier

Gold Cover: Understanding the Highest Health Policy Tier

Check out our range of private health funds

iSelect does not compare all providers or policies in the market and not all policies or special offers are available at all times, through all channels or in all areas. Not all policies available from our providers are compared by iSelect and due to commercial arrangements and customer circumstances, not all policies compared by iSelect are available to all customers. Learn more.

What is Gold Hospital Cover?

Gold Cover policies are pretty awesome, offering more protection than any other type of Hospital Cover. In fact, they sit at the very top of the ‘tier system’ that the Aussie Government introduced in 2019,1Australian Government | Department of Health and Aged Care – Private health insurance reforms and as a result you may hear Gold Cover also referred to as ‘top cover’. With Gold, you’ll get coverage for more in-hospital treatments than Basic, Bronze or Silver policies.2PrivateHealth.gov.au – Product Tiers

Why go Gold?

Among the number of things that Gold has going for it, includes that it covers you for more medical treatments than other tiers of Hospital Cover.3As above It also ensures unrestricted cover for every category of in-hospital treatment.4PrivateHealth.gov.au – Product Tiers

Who is Gold Cover suitable for?

People planning pregnancy

If you’re planning on getting pregnant and want to give birth as a private patient in a private hospital, and/or have the option of choosing your own obstetrician, then Gold cover may be for you. Gold hospital insurance also gives people who are having difficulty conceiving access to in-hospital IVF treatment (as long as it’s medically required).

People with chronic conditions

Gold cover might suit people who suffer from diabetes, osteoarthritis or other chronic conditions. The right level of cover can give them the option to get treated in a private hospital and (potentially) skip the public system’s waiting lists. This means they might be able to get treatments like a hip replacement or an insulin pump sooner rather than later.

Older Australians

Sadly, as you get older, you are more likely to be affected by certain conditions. By the age of 80, most people will develop cataracts1Healthdirect – Cataracts and around 1 in 10 Australian adults has signs of chronic kidney disease.2Healthdirect.gov.au – Chronic kidney disease

People who want peace of mind

Even people who don’t fall into these categories may find Gold Cover useful. One of the best ways to determine if it’s a good match or not is to simply think about whether you’ll ever need medical treatment for the additional conditions it covers, or simply prefer to have the peace of mind.

But if you don’t think you’ll need it (or if you’re fine with getting treatment as a public patient), then a lower product tier might be worth considering.

Frequently Asked Questions

What treatments does Gold Cover insure?

Like all Hospital Cover policies, Gold Cover helps cover your medical costs when you’re admitted to hospital as a private patient. It also gives you greater ability to choose your own doctor and hospital.3PrivateHealth.gov.au – What is covered by private health insurance?

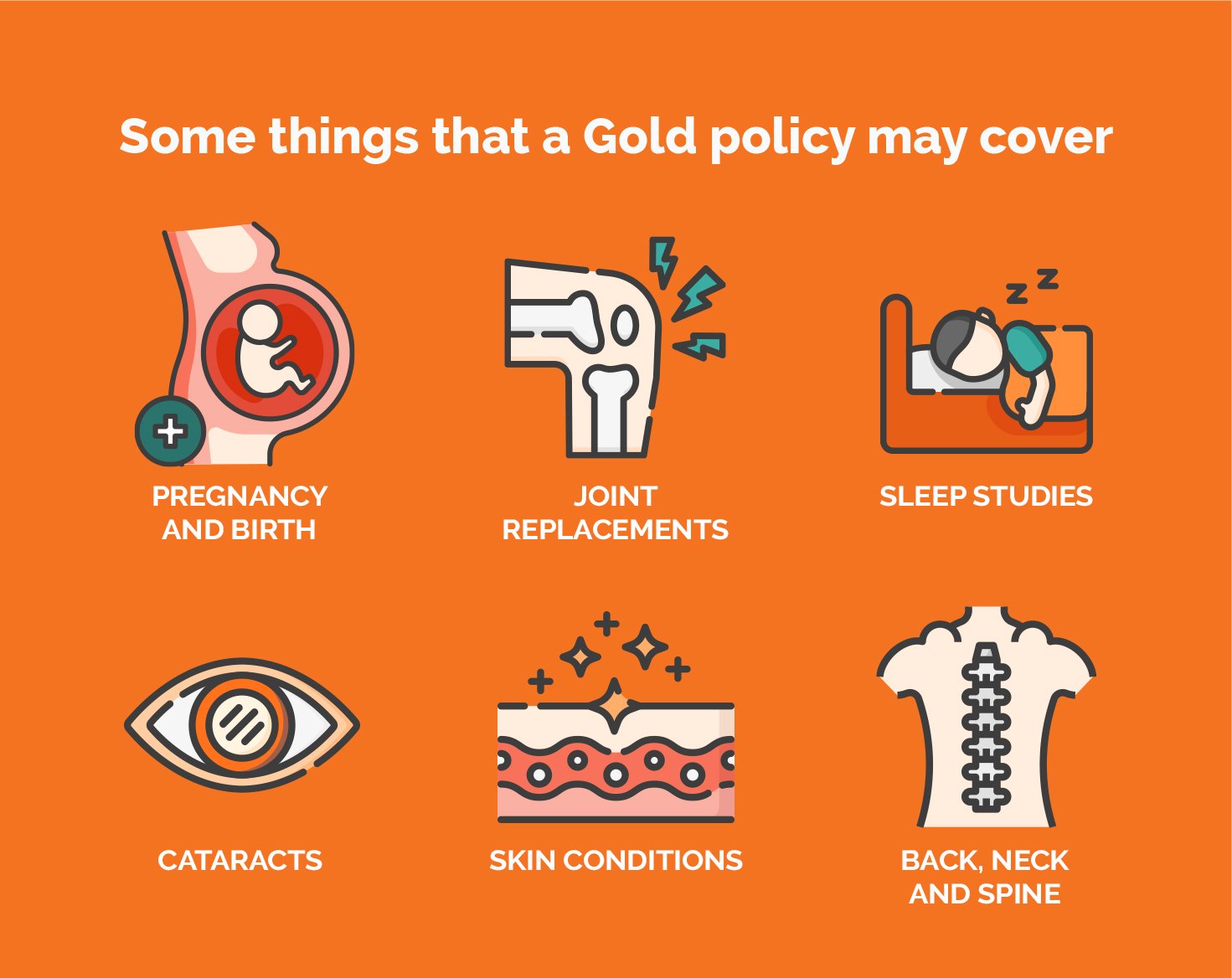

But wait—if all Hospital Insurance gives you this kind of coverage, then why does Gold Cover get to sit atop the podium? Put simply, it’s because gold policies will cover you for more clinical categories of treatment. This includes certain things4Australian Government | Department of Health and Aged Care – Private health insurance reforms | Gold, Silver, Bronze, Basic product tiers | Campaign fact sheet (Page 2) that are only optional for the other tiers such as:

- Pregnancy and childbirth

- Weight loss surgery

- Joint replacements

- Cataracts

- Sleep studies

- Assisted reproductive services

- Dialysis for chronic kidney failure

- Devices for pain management

- Insulin pumps

Gold Cover also insures you for every kind of medical treatment that the lower product tiers cover. This means you’ll also be covered for the digestive system, the back, neck and spine, cancer treatments, in fact, it covers you for all 38 clinical categories of treatment. It’s the bells and whistles of hospital cover!

Is there any way to reduce my premiums for Gold Cover?

There certainly is! While you don’t have as much wriggle room here as you might for, say, Car Insurance, most insurers will still provide some options that can help reduce your premiums. Some ways to save might include:

- Increase your excess

Most insurers will charge you an out-of-pocket cost whenever you make a claim called an excess. Selecting a higher excess can result in lower premiums, which can be a great option for those who think they’re unlikely to claim on their policy.

- Pay with direct debit

Some health insurers will apply a discount to regular premiums if you pay by direct debit instead of BPAY or via credit card.5nib – Payments Over time, this could save you quite a bit of money on your policy.

- Compare regularly

It can pay to keep an eye out for other policies—especially if you’ve held onto your cover for a while. Just because your Gold policy was the cheapest option a few years ago doesn’t mean it will stay that way. It’s a good idea to compare what’s out there and see if another policy offers more value.

Even if your Gold Cover costs a bit more than other policies, these little strategies can quickly add up and help your money go even further than usual.

What are the waiting periods for Gold Cover?

Gold Cover has the same maximum limits for waiting periods as other hospital policies. A waiting period refers to how long you have to hold a policy before you can claim for certain conditions. For Hospital Cover, the legal requirements6Commonwealth Ombudsman | Private Health Ombudsman – Waiting periods for private health insurance (Page 2) are no more than:

- Two months for psychiatric care, rehabilitation or palliative care (even if it’s for a pre-existing condition)

- Twelve months for all other pre-existing conditions

- Twelve months for pregnancy and obstetrics

- Two months for all other conditions and treatments

Insurers can technically offer shorter waiting periods, but it’s honestly quite rare to find a policy that doesn’t apply the maximum limits. Most insurers—big and small—are generally the same on this front.

Where can I compare Gold Cover policies?

Because Gold policies cover you for more, they also generally cost you more too. And while you might be paying higher premiums, you don’t want to be paying more than you need to for Gold cover.

Like with most things, it helps to do your research when you’re looking for Gold Cover. But doing so doesn’t have to be a slog. Comparing policies can be quick and easy with the right approach.

That’s where iSelect can help. You can compare Health Insurance policies (including Gold Cover!) from a range of providers with our online comparison tool.* So give it a spin if you’re ready to try and find a great deal—or give our friendly team a call on 1800 784 772.

Health Insurance & Tax

Tax Implications on Health Insurance

How to save on Health Insurance

About the Medicare Levy Surcharge

About the Life Time Health Cover Loading

Government Rebate & Means Testing

.svg)