Compare Car Insurance Policies

Save time and effort by comparing a range of car insurance quotes with iSelect

.svg)

13 19 20

13 19 20

Save time and effort by comparing a range of car insurance quotes with iSelect

The key differences between insuring your car with an agreed value vs market value

What is agreed value Car Insurance?

What is market value Car insurance?

How do you choose between agreed or market value?

Is an agreed value policy only available for comprehensive Car insurance?

Do I need to keep my car in a certain condition?

So, what’s the verdict on agreed and market value policies?

Where can I compare Car insurance policies?

You’ve already got plenty to consider when selecting car insurance. There’s the level of cover, the excess and an array of optional extras you might want to add to the policy. But when it comes to comprehensive car insurance, you’ll also want to think about how you’ll insure your car.

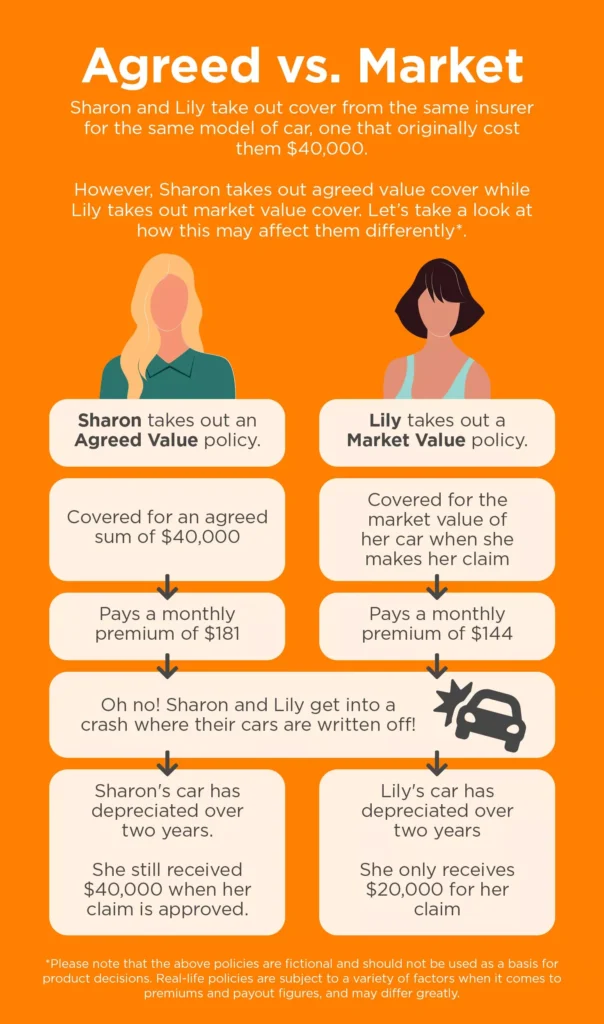

This is where agreed value and market value come into play. These are two different ways of insuring your vehicle and they can affect the premiums you end up paying—as well as the payout you get if you ever need to make a claim.

| Agreed Value | Market Value |

| Premiums are generally higher. | Premiums are generally lower. |

| Payout figure stays the same over the policy period. | Payout figure depends on the car’s estimated value at the time of the claim. |

| You’ll (usually) know how much you’ll get for a total loss claim in advance. | Less clarity regarding the payout figure for a total loss claim |

| Payout figure unaffected by depreciation | Payout figure typically goes down with depreciation |

This is pretty straightforward. When you take out agreed value Car Insurance, your insurer agrees to pay a certain amount if your car is destroyed, stolen or written off.

That means that you’ll receive a fixed, set amount if you need to make a total loss claim. This doesn’t typically change over your policy term, even if your car depreciates in value. The agreed sum will generally stand until your policy is due for renewal.

Market value Car insurance is a little bit different. You don’t ‘agree’ to a sum with your insurer beforehand. Instead, if you make a total loss claim, your car gets covered for how much it’s worth on the market at the time.

An assessor will usually estimate its value when you make the claim, taking into account the car’s make, model and condition to arrive at a payout figure. It’s important to note that because cars depreciate in value over time, this payout figure will usually be less than the original price you paid for the car.

The main point of difference between agreed and market value insurance is with premiums and payout figures. Neither value type is ‘better’ than the other. Instead, the choice comes down to your particular needs and what you want out of a policy.

Here are a few pointers to help you make your decision.

You might consider agreed value if…

You might consider market value if…

Helpful Tip:

Market value cover may be a useful option to consider for older cars or vehicles that have seen a lot of mileage. Typically, these vehicles will have already depreciated in value, and this can result in lower premiums. While you might not receive as much for a claim as you would under an agreed value policy, it may still be enough to cover the costs of a replacement car (so long as you’re not looking to upgrade to a Ferrari).

Generally speaking, yes.

Because comprehensive insurance is specifically geared towards covering your own car, it makes sense for the policy holder to settle on an agreed sum for a total loss claim. This isn’t usually something you would decide upon to cover the repairs should you damage someone else’s car.

That being said, many providers will give you the option to choose between value types when it comes to comprehensive Car Insurance. This is true for Budget Direct, Virgin Money and ING (among others).

This may depend on the specific terms of your policy. As such, it is best to review your insurer’s Product Disclosure Statement (PDS), or speak to your insurer regarding the conditions of your agreed or market value policy.

That being said, many insurers will place some general exclusions on the policy where they will refuse to pay a claim. For instance, Budget Direct5 will not pay a claim if the insured car is ‘in an unsafe, unroadworthy or overloaded condition, unless this condition did not contribute to the loss or damage.’1Budget Direct – Product Disclosure Statement Part A (Page 14)

Even if you keep your car in a safe and roadworthy condition, it might still be best to ask your insurer if you need to provide regular updates. Some might require immediate notice if the condition of your car changes—even if you think it’s for something minor. Ask your insurer to be certain!

While some people may decide to take out market value policies because they’re generally more affordable, others may prefer the greater certainty offered by an agreed value policy. It’s very much a matter of what you prefer.

In either case, it’s also a good idea to check out the PDS before you decide on a policy as this will have information about the policy’s features, inclusions and exclusions. And these differences can be just as monumental as those between agreed and market value Car insurance.

If you’re interested in finding Car insurance, then feel free to use our online comparison service to compare policies from a range of providers*, or call our friendly team on 13 19 20.

Save time and effort by comparing a range of car insurance quotes with iSelect

iSelect does not compare all car insurers or policies in the market. The availability of policies may change from time to time. Not all policies available from iSelect’s providers are compared by iSelect and due to commercial arrangements, area or availability, not all policies compared by iSelect will be available to all customers. Some policies are available only from iSelect’s call centre or website. A number of our participating general insurance brands are arranged by Auto & General Services Pty Ltd ACN 003 617 909 on behalf of Auto & General Insurance Company Limited 111 586 353, both of which are related entities of iSelect Limited. Our relationship with those companies does not impact the integrity of our comparison service. Click here to view iSelect’s range of providers.

iSelect General Pty Limited ABN 90 131 798 126, AFS Licence Number: 334115. Any advice provided by iSelect is of a general nature and does not take into account your objectives, financial situation or needs. You need to consider the appropriateness of any information or general advice iSelect gives you, having regard to your personal situation, before acting on iSelect’s advice or purchasing any policy. You should consider iSelect’s Financial Services Guide which provides information about our services and your rights as a client of iSelect. iSelect receives commission for each policy sold that is a percentage of the premium or a flat fee. Ask us for more details before we provide you with any services.