Why empty nest Health Cover might be right for you

Why empty nest Health Cover might be right for you

Compare Health Insurance Policies

Save time and effort by comparing a range of Australia’s health funds with iSelect

Why does Health Insurance matter for empty nesters?

What are the big health concerns of empty nesters?

How can I adjust my Health Insurance?

Can my kids still stay on my Health Insurance policy?

Where can I find and compare Health Insurance?

As your children grow into adults who live their own lives, it hopefully means that eventually they’ll live in their own homes too! While a much quieter home may take some getting used to, lots of people affectionately refer to this new life stage as empty nesting!

Now that your adult children have (perhaps finally!) left home, your family Health Insurance policy may not be as relevant as it used to be. For example, you may no longer need cover for services like braces or swimming lessons now that the kids are off your hands. Removing services that aren’t relevant anymore could help you save money, and let you focus on services you actually need.

Some Health Insurance policies are even geared towards ‘empty nesters’ and provide cover for things you may find you start requiring as you get older, rather than catering to the needs of teenagers and young adults. It’s a great time to compare policies and find one that suits your new stage of life.

Why does Health Insurance matter for empty nesters?

In the year ending 31 March 2023, there was an increase in the number of Aussies over 50 taking out Private Health Insurance, up by 2.3 percent from the previous year.1Australian Prudential Regulation Authority – Quarterly Private Health Insurance Statistics – highlights, page 3. In other words, Health Insurance for Australians over 50 is on the rise!

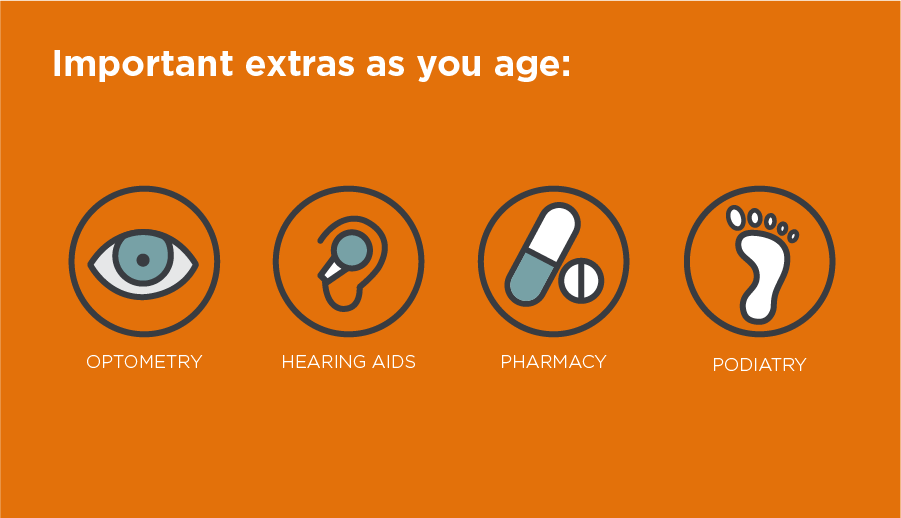

As you age, certain health services and procedures may become more common, and some of these things might not be covered by Medicare, such as:2Australian Government Department of Health and Aged Care – What Medicare covers

- ambulance services (although you may not need to pay for emergency ambulance services if your state or territory provides a discount or subsidised scheme)3Commonwealth Ombudsman of Private Health Insurance – Ambulance

- most dental services

- glasses and contact lenses

- hearing devices

- elective and cosmetic surgery

- services not on the Medicare Benefits Schedule (MBS)

- services provided through the private health system

This is where Private Health Insurance can help! But it’s important to make sure you still hold suitable cover which is why you should regularly review your policy inclusions and exclusions to make sure it meets the needs of your empty nest!

And if you’re no longer financially supporting your children, you might even have some spare cash for Extras that could help keep you fit and healthy for years to come!

What are the big health concerns of empty nesters?

There are a number of health conditions that can become more prevalent as you age.

Chronic conditions like diabetes, arthritis and other musculoskeletal problems and respiratory conditions are all common in an ageing population.4WHO – Aging and Health

You may notice that it’s getting a little harder to hear or see things up close or at a distance… all of which can be annoying, but altogether quite common!

All those trips to the optometrist, chiropractor or osteopath can really take a toll on your pocket! And, although age comes with wisdom, it can also come with an increase in physical ailments, and the last thing you want to worry about is long waiting times for elective surgery in the public health system.5Australian Institute of Health and Welfare – Elective Surgery

Even if you’re a relatively fit and healthy empty nester, having a suitable Health Insurance policy can be a great way to give you peace of mind as you enter this next phase of life.

How can I adjust my Health Insurance?

There are a few ways you can help your Health Insurance policy better suit your budget or needs. Here are some recommendations:

- Move from a Family policy to a Couples or Singles policy

In 2021, the Australian Government increased the maximum age of dependents on Private Health Insurance policies from 24 to 31, although it does vary between different funds and policies, and can depend on whether your child is still studying or living at home.6Commonwealth Ombudsman of Private Health Insurance – Frequently Asked Questions And while you can choose to keep your adult children covered under your family policy a little longer, you might not want to!

You can get in touch with your insurer and ask them if you can move to a Couples or Singles policy – there’s no point paying for your kids if they have long since flown the nest!

- Increase your level of cover for your changing health needs

When it comes to Health Insurance, and more specifically, Hospital Cover, insurers commonly offer four different product tiers, known as Basic, Bronze, Silver, and Gold.7Commonwealth Ombudsman of Private Health Insurance – Product Tiers

Each product tier offers certain clinical categories for which you’re covered, and these categories can be presented as: a requirement for the level of cover, a restricted amount for the level of cover, or an optional extra for the level of cover.8As above.

Some funds also have policies called ‘Plus’ policies, like Silver Plus or Bronze Plus. These policies include the minimum requirements for a Silver or Bronze policy, but with some additional services, without having to jump fully up to the next tier.

Let’s say you need an implanted hearing device. In this case, you would need to opt for a Silver or Gold policy rather than a Basic or Bronze policy to ensure you have access to this service.9As above.

- Drop cover or optional Extras that you no longer need

You may find that you no longer need certain services like pregnancy cover, but you still want a high level of Hospital Cover on your policy. In this case, you may want to drop down from a Gold policy (generally, the only type to cover pregnancy) to a Silver policy, which can still include things like heart surgery or implantation of hearing devices.10TUH – Silver+ No Pregnancy Hospital Cover

Alternatively, you may decide that while it’s important to you to keep a higher level of Hospital Cover as you age but to save money, you’ll opt for a lower level of Extras Cover or a flexible extras product that allows you to focus on those Extras services you’re more likely to use.

It’s well worth shopping around before settling on a policy that’s better suited to your new lifestyle, sans kids!

Can my kids still stay on my Health Insurance policy?

That’ll depend on your insurer and your child’s age. If your kids are still covered under your policy, think about whether it’s still worth your while. Now could be a good time to get your head around how insurers classify adult children as dependants.

Each insurer can define what a dependant is on their Health Insurance policies, but there are general requirements that they need to follow. The maximum age an insurer can cover a dependent on their parents policy is 31, although with some funds, it’s younger.11Commonwealth Ombudsman of Private Health Insurance – Frequently Asked Questions

There are also different types of dependents, usually categorised in three different ways: Child Dependant, Student Dependant, and Adult Dependant.12Ahm – Health Insurance for families explained

- Child Dependant: Children up to the age of 21 who are single.13Medibank – Student and Adult Dependants

- Student Dependant: Children over the age of 21, up to 31 who are single and studying full time.14HCF – Cover Options for Dependants

- Adult Dependant (on selected policies): Children over 21 and up to the age of 31 who are single and not studying full time.15Teachers Health – Managing your Membership, Adding a Person

Your insurer may have these categories in place, or they might have a different system altogether.

For example, some insurers will include your child as a Child Dependant under a Family or Single Parent Policy until they turn 25, as long as they live at home with you and are not married or in a de-facto relationship.16AIA Health – Member Guide, page 5

Other insurers will allow your adult children to remain on certain family policies until they turn 31, by paying an additional Extended Family Cover premium.17HCF – Cover options for dependants

Long story short: don’t be afraid to do a little research! You might be surprised with the number of competitive policies on offer. Hopefully, you can find something that suits you and your adult kids.

And if your kids are too old to be considered as dependents (or it’s time for a little financial independence!), then it might be time to switch from your family cover to a couples or singles policy!

Where can I find and compare Health Insurance?

If you think it might be time to fine tune your policy to ensure its meeting your current needs, you can call one of our friendly iSelect team members today and discuss health insurance on 1800 784 772.*

WE’RE HERE TO HELP

Need help with health insurance?

We can help you find a suitbable product for your needs

Health Insurance & Tax

Tax Implications on Health Insurance

About the Medicare Levy Surcharge

About the Life Time Health Cover Loading

Government Rebate & Means Testing

.svg)