How Much Life Insurance Do You Need?

How Much Life Insurance Do You Need?

*iSelect’s partnered with Lifebroker to help you compare a range of Life Insurance policies. Not all policies are available at all times or in all areas. Any advice provided on this website is general in nature and does not consider your situation or needs. Please consider if any advice is appropriate for you before acting on it. Learn more.

Easily compare life insurance quotes

Save time and effort by comparing life insurance with iSelect’s trusted partner Lifebroker*

What if you’re underinsured?

Protecting your family’s future is the biggest benefit of having life insurance, so it’s important to consider whether the payment they receive is enough to cover their general living expenses.

Some professions naturally put you at a higher risk of having a serious workplace related accident than others or alternatively you may wish to protect yourself if you were to suffer a serious illness. Cover for these types of events usually comes from life insurance related products such as total and permanent disability cover (TPD), trauma cover, or income protection.

As mentioned, these types of policies are more relevant if you want to protect yourself in case of a serious illness or injury. This way, if something unfortunate should happen, you’ll be able to focus on recovering without stressing about your finances.

What if you’re over insured?

Over insurance means that you’re paying for levels of life insurance that you won’t use or are unlikely to use. The impact of this is that you could be paying unnecessarily excessive monthly insurance premiums.

It’s important that Australians take the time to understand the cost of premiums, both now and in the future.

It’s also important to pay attention to what is and isn’t covered in a potential policy, and how your medical history may affect your ability to apply for insurance cover or to make a claim in the future.

How much is life insurance in Australia?

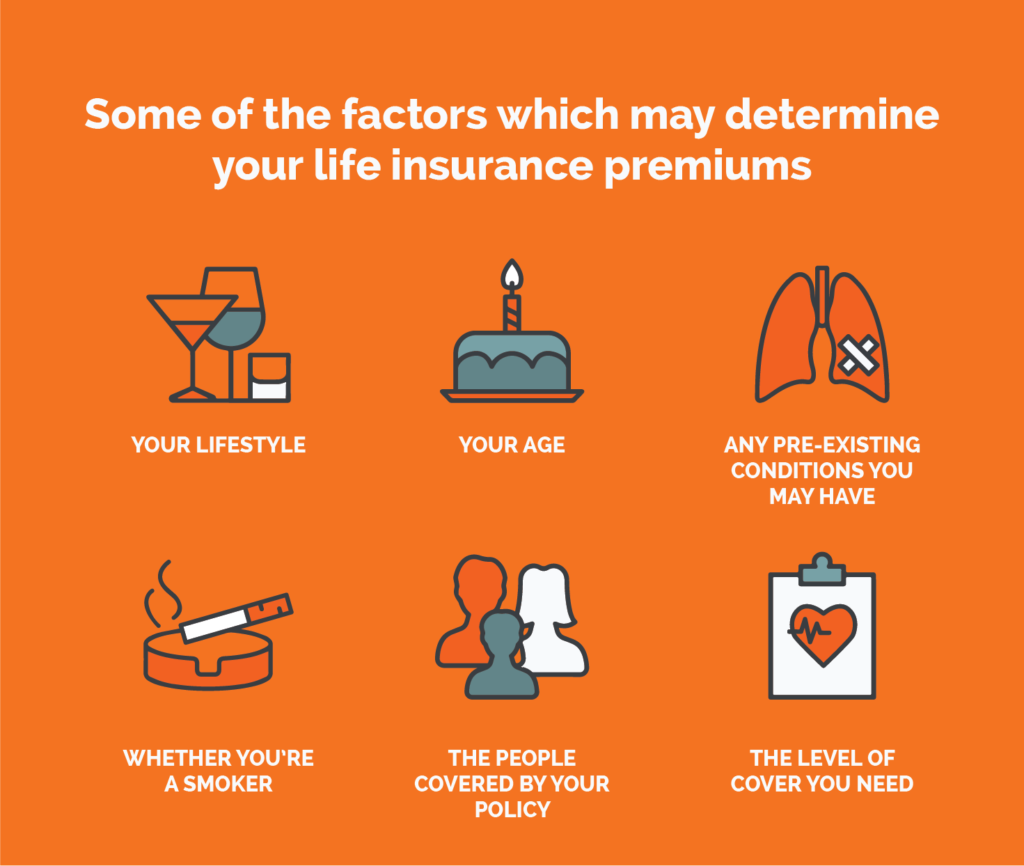

Life insurance premiums vary significantly from policy to policy, and provider to provider. Your premiums will be calculated based on a variety of factors, including:

- Whether you’re a smoker

- Your age

- Your lifestyle

- Any pre-existing conditions you may have

- The level of cover you need

- The people covered by your policy, such as children or a spouse

One way to find out what life insurance premiums may cost you is to compare policies from a range of providers through iSelect with trusted partner Lifebroker. We’ll show you a number of policies, allowing you to compare providers, prices, and levels of cover all in one place.

How much life insurance do I need?

MoneySmart recommend that you consider two main factors to work out how much life insurance cover you may need:1MoneySmart – Life cover

- Need – to pay mortgage, credit cards and debts, childcare and school fees etc.

- Receive (benefits) – from super, savings, the sale of investments, your paid leave balance and support from family

There may be other factors that you need to consider based on your needs and circumstances. For example, your budget is also an incredibly important factor to consider when purchasing any policy, including life insurance.

How to calculate your life insurance needs

It’s a good idea to start by considering every potential living cost you or your family may incur over a typical year. This may include living costs, education, entertainment, utilities, mortgage, and anything else that may be a recurring expense.

How to calculate your life insurance benefits

This can include payments you may receive upon your death, such as superannuation, bank balances, employment payouts (such as annual leave), shares, or existing life insurance policies. It’s recommended that the level of cover you insure yourself for is sufficient to cover your costs of living. It’s also important to consider ongoing expenses.

For example, do you want your family to be covered for five years, ten years, or even the rest of their lives? If so, the life insurance payout that’s required will significantly increase – as will your premiums.

What life insurance can you afford?

It’s important to ensure that you can afford your monthly premiums to get the level of cover you require. That’s why our trusted partner, Lifebroker, helps you to compare policies from their range of providers and find an option for you and your budget*.

How to review your life insurance

Life insurance is not a ‘set and forget’ policy. Like other insurances, it’s a good idea to review your life insurance policy every time your income or personal circumstances change. This means that any time you change jobs, have children, increase or pay off your mortgage, inherit money, change your income levels, or alter your living expenses in any other way, then it may be a good time to review and compare policies.

Whether you’re considering purchasing life insurance for the first time, or are reviewing your current policy, Lifebroker’s team of qualified consultants can try to help you find a suitable policy. Compare from a range of providers online, or call us on 13 19 20 today.

Easily compare life insurance quotes

Save time and effort by comparing life insurance from a range of policies and providers with iSelect’s trusted partner Lifebroker*

**iSelect’s partnered with Lifebroker (AFS Licence number: 400209) to help you compare a range of Life Insurance policies. iSelect earns a commission from Lifebroker for each customer referred through the website or contact centre. Lifebroker do not compare all life insurers or policies in the market.

iSelect Life Pty Ltd – ABN 89 124 304 347, AFS Licence Number 331128. Any advice provided by iSelect is of a general nature and does not take into account your objectives, financial situation or needs. You need to consider the appropriateness of any information or general advice iSelect gives you, having regard to your personal situation, before acting on iSelect’s advice or purchasing any policies. You should consider iSelect’s Financial Services Guide which provides information about iSelect services and your rights as a client of iSelect.’

We'd love to know what you think of our website so we can improve it!

- 1.MoneySmart – Life cover

.svg)