Couples Health Insurance

Couples Health Insurance

Compare Health Insurance Policies

Save time and effort by comparing a range of Australia’s health funds with iSelect

What are the different types of couples health insurance?

What is hospital cover?

What is extras cover?

What are the benefits of couples insurance?

How does lifetime health cover loading apply to couples health insurance policies?

If I have couples health insurance, do I still have to pay the Medicare Levy Surcharge?

How to get a good deal on your couples health insurance

Compare couples insurance policies online with iSelect

Simply put, a couples health insurance policy is a single policy that covers two adults. And those two adults don’t have to be married, just in a relationship. It can be taken out by married, de facto or registered couples.

Both you and your partner will receive cover for the same things at the same level of coverage. This makes things simple to understand, but if you and your partner have very different medical needs then it might be worth considering two singles policies that are tailored to your individual requirements. Either way, we’ll cover the ins and outs of what you need to know.

What are the different types of couples health insurance?

In Australia, we’re lucky enough to have one of the best public health systems in the world. Through our tax payments, we’re all provided with basic health care via Medicare. And for a lot of things, this is sufficient. But the reality is, it doesn’t cover everything you may need to live the life you want.

This is why private health insurance is still widely used in Australia. As well as procedures that aren’t covered under Medicare, private health insurance also provides more options for your hospital health care such as the ability to “skip” the long public waiting lists for elective surgery, and choice of doctor and hospital.

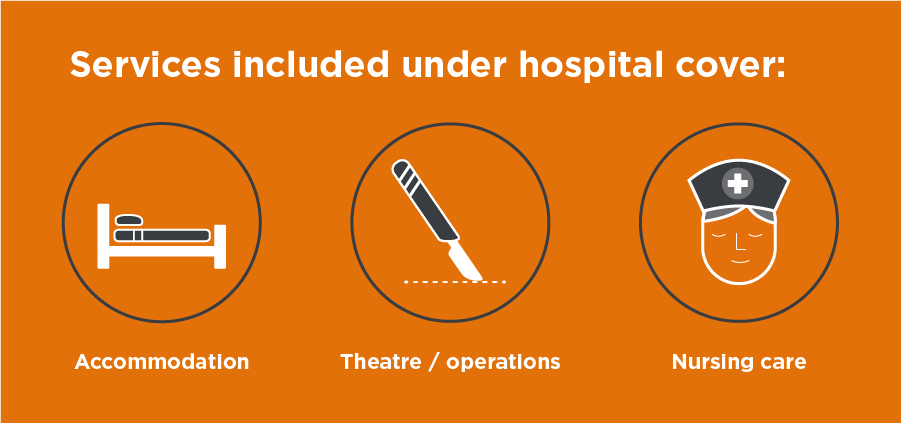

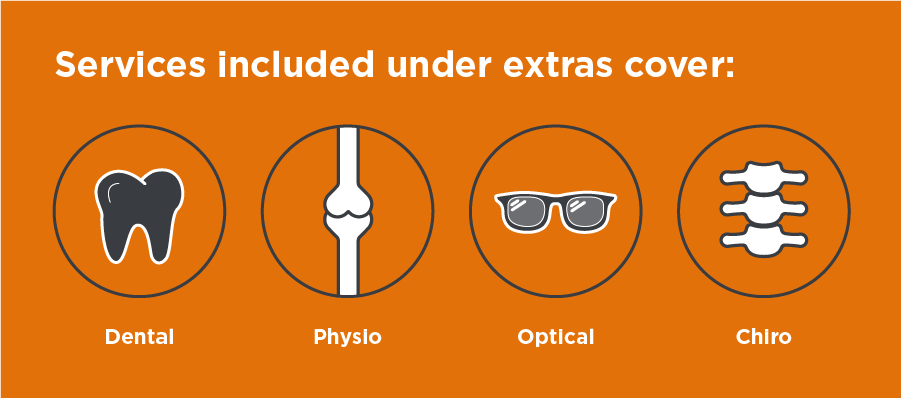

Generally speaking, there are two types of couples health insurance. The first is hospital cover, which includes coverage at a participating private hospital for things like accommodation and theatre fees, a contribution to the doctors charges or nursing care. Then, there’s extras cover which includes additional things like physio, dental cover and other non-hospital services which are normally not covered by Medicare. The two can also be combined as hospital and extras cover. The specific services offered by your health fund will vary from provider to provider, as well as your level of cover.

What is hospital cover?

In short, hospital cover does what it says on the box, which is to cover your hospital costs in a participating private hospital. This can include things like operation fees, accommodation, and nursing care. Most significantly though for elective surgery it gives you the ability to avoid the public waiting list. You can also select where you’re treated and by whom. You might also be able to stay in your own private room and access additional support programs as part of your hospital policy selection. depending on your level of cover.

What is extras cover?

Extras cover relates to some other non-hospital treatment and therapies that you might need, so it’s going to differ from person to person. It covers things like dental, physio, chiropractic and optometry.

Many providers offer combined policies that cover hospital and extras, so if you want to be covered for both your regular ongoing medical requirements as well life’s hiccups, hospital with extras cover is a good place to start.

What are the benefits of couples insurance?

No matter the level of cover you have, hospital, extras, or a combination of both, couples health insurance can provide comfort in knowing that you and your partner are supported in not only your day to day medical needs, but also in the event of something unexpected. Shared cover not only provides that peace of mind, but also cuts down on paperwork and admin – a major distinction in the couples vs singles health insurance debate.

How does lifetime health cover loading apply to couples health insurance policies?

If you’re approaching 30 and don’t currently have health cover, it’s worth thinking about sooner rather than later. Lifetime Health Cover Loading (LHC) is applied to those who don’t take out hospital cover before they turn 31.1https://www.ato.gov.au/Individuals/Medicare-levy/Private-health-insurance-rebate/Lifetime-health-cover/ For those who don’t, a 2% loading will apply on top of their hospital premium for every year over the age of 30.

For couples, the LHC loading works slightly differently. The loading itself, if applicable, is averaged out between the hospital policies.2https://www.privatehealth.gov.au/health_insurance/surcharges_incentives/lifetime_health_cover.htm For example, if you incur a 4% loading, and your partner a 2% loading, you would end up with a 3% loading on your total couples policy for the hospital component.

And what if one partner took out health insurance before 31 and one didn’t? Well, the same applies. So if one of you has no loading, and the other a 10% loading, then the LHC loading on your couples policy would be 5%. It really comes down to what is most suitable for you and your partner and that is where we can help.

If I have couples health insurance, do I still have to pay the Medicare Levy Surcharge?

As long as you, your partner or any of your dependants have an appropriate level of hospital cover, there’s no requirement to pay the Medicare Levy Surcharge.

Furthermore, depending on your income, you may even receive a rebate on your private health insurance. Another benefit of being on a couples policy is if your partner is older and entitled to a higher government rebate, you also get the higher rebate applied to reduce your combined premium. In many cases it “pays” to stay together.

How to get a good deal on your couples health insurance

Relationships are full of life-impacting decisions. Buying a home, planning a family, relocating for work, but no matter what stage you’re at or what you’re preparing for there’s nothing worse than being stung by unexpected expenses. Here are some simple ways to keep your costs down and get some real value from your couples health insurance.

The first consideration is the components of your plan. Taking the time to look through all the benefits you and your partner need, and removing anything unnecessary, could lead to some noticeable savings. For example, older couples might not need orthodontic cover Young couples with no ongoing health issues might not need any extras at all. It pays to look at the finer details of your plan.

Another way to save on couples health insurance is to pay a year in advance. Often, premiums will increase each year on April 1st. So if you’ve got the resources, paying your health insurance ahead of time could lock in the lower price.

Compare couples insurance policies online with iSelect

One of the simplest ways to save on your couples health insurance is to compare health policies regularly even once you have set up your insurance. . Not only will your needs and requirements change over time, but the provider you initially took out your policy with may not be as cost effective in 2 years time. It costs nothing to look into, so at worst case, it’s a phone call giving you the peace of mind your cover is suitable for your needs, best case, more money in your pocket!

iSelect can help you and your partner find a suitable health insurance policy. See how much you could save with iSelect.

Compare health insurance policies the easy way

Save time and effort by comparing a range of Australia’s health funds with iSelect

WE’RE HERE TO HELP

Need help with health insurance?

We can help you find a suitbable product for your needs

Health Insurance & Tax

Tax Implications on Health Insurance

About the Medicare Levy Surcharge

About the Life Time Health Cover Loading

Government Rebate & Means Testing

.svg)