Interest rates: What they are and how they work

Interest rates: What they are and how they work

*iSelect is the trading name of iSelect Mortgages Pty Ltd (ABN 86 148 217 181). iSelect Mortgages Pty Ltd is a credit representative (Credit Representative 400540) of Auscred Services Pty Ltd (Australian Credit Licence 442372). iSelect provides a referral to Lendi Pty Ltd, a Credit Representative of Lendi Group Finance Pty Ltd (Australian Credit License 442372). iSelect Mortgages Pty Ltd receives a commission from the Licensee for each new customer account created and for each home loan submitted through this service. Learn more.

Compare home loans the easy way

We partnered with Lendi* to help you compare home loans from over 25 lenders and over 2,500 home loan products.

What are interest rates?

Why do interest rates change?

What are the different types of interest rates?

Why have interest rates gone up so much recently?

What else affects my interest rates?

How is interest calculated on a Home Loan?

How can I reduce my interest?

Where can I compare Home Loans?

If there’s one regular news story that homeowners keep an eye on, it’s what the Reserve Bank of Australia (RBA) is up to. Have they raised interest rates? Are they steady? Are interest rates going down? Although this last one seems to happen less often. But when we’re not watching the constant flow of interest rates, we could stand to learn a bit more about how they work.

What are interest rates?

When you borrow money to buy a home, you pay back the bank principal and interest. Principal is the lump sum that you borrowed, and interest is an extra fee on top that the lender charges as payment for using their money.

The interest rate is expressed as a percentage of the principal. Most interest rates you see are a percentage per year, which you then pay back along with your regular monthly (or fortnightly, or weekly) repayments.

Why do interest rates change?

You go to commercial banks to borrow money, but those commercial banks go to the RBA to borrow money. The interest rate the RBA charges commercial banks is what determines the national ‘cash rate’.

The RBA knows that the commercial banks will use the cash rate to decide what interest rates they’ll set for their own products, including Home Loans and savings accounts, so they use the cash rate to try to keep economic factors (like inflation and unemployment) between certain target levels.

A low cash rate means it’s cheap to borrow money and you don’t earn much by saving it. The RBA will lower cash rates to encourage people to spend money and help the economy grow. A high cash rate means it’s expensive to borrow money and you earn more on your savings accounts, which means people are less likely to spend money. The RBA does this to try and stop people from spending, pushing down prices and reducing inflation.

What are the different types of interest rates?

When it comes to loans, there are a few interest rate options, each offering their own particular features.

Variable interest rates

The most common choice. Variable interest rates fluctuate along with the market. If the cost of lending goes up, the interest rate usual will too. Variable loans tend to come with other features to make them more flexible and attractive, such as 100% offset accounts.

Fixed interest rates

Fixed interest rates stay the same for a set time period regardless of what the market is doing. They usually stay fixed for somewhere between 1-5 years.

Split rates

A split rate is like betting on both sides. You can fix part of your loan and leave the rest variable. This gives you an element of certainty, as well as the opportunity to take advantage of the flexibility that comes with variable rates.

Honeymoon rates

Many lenders will offer new customers very low introductory rates on Home Loans. The low rate will only apply for a short period of time before going back to the typical amount. While these honeymoon rates can be attractive, it’s important not to get swept up in them and make sure you can manage the loan once the honeymoon rate is over.

Why have interest rates gone up so much recently?

Throughout 2019-20 during the COVID-19 pandemic, the RBA made the cash rate very low to encourage spending. However because there was high demand for goods and services but low supply, prices went up, also known as inflation.

In May 2022, the RBA has began raising the cash rate to try and combat the inflation, so the banks and lenders have been passing the higher cash rates onto their customers in the form of higher interest rates on Home Loans. Between May 2022 and November 2023, the RBA raised the cash rate thirteen times, increasing interest rates by a total of 4.25%.

What else affects my interest rates?

The cash rate isn’t the only thing that impacts interest rates though. Other factors include:

| Loan type | Home Loans can be fixed or variable (or a combination of the two). If lenders expect the cash rate to rise, the fixed rate will usually be higher than the variable rates. If they think cash rates will fall, the fixed rate will usually be lower than the current variable rate. Fixed rates are good for budgeting and predictability, but variable rates have the chance of going down or, more likely, up |

| Loan purpose | Many lenders offer different interest rates depending on whether the loan is for an investment property or a place to live. Loans for investment properties tend to have higher interest rates because there’s more risk involved, especially if the investor relies on the rental income to make the repayments. |

| Credit history | When applying for a Home Loan, lenders will look at your credit history. For people with a poor credit score or with a history of not being able to pay back other loans, they might charge higher interest rates because of the perceived risk. |

| Loan-to-value ratio (LVR) | LVR stands for loan to value ratio, which is the loan amount expressed as a percentage of the value of the property. The bigger your deposit, the lower your LVR will be. If you have a smaller deposit and therefore a higher LVR, lenders may charge higher interest rates. |

| Lender’s mortgage insurance (LMI) | LMI, which stands for lender’s mortgage insurance, is an insurance policy that protects the lenders if the borrower can’t make their repayments. LMI is usually added to the overall loan, which means you would be paying interest on that too. LMI is usually required if your deposit is less than 20% of the property value. |

| Lender’s needs | Lenders also use interest rates to cover their own financial needs. They may raise them to cover their own costs, or they may lower them to stay competitive and attract new customers. |

How is interest calculated on a Home Loan?

Ready for some maths? No? Well, sorry. It won’t take a minute.

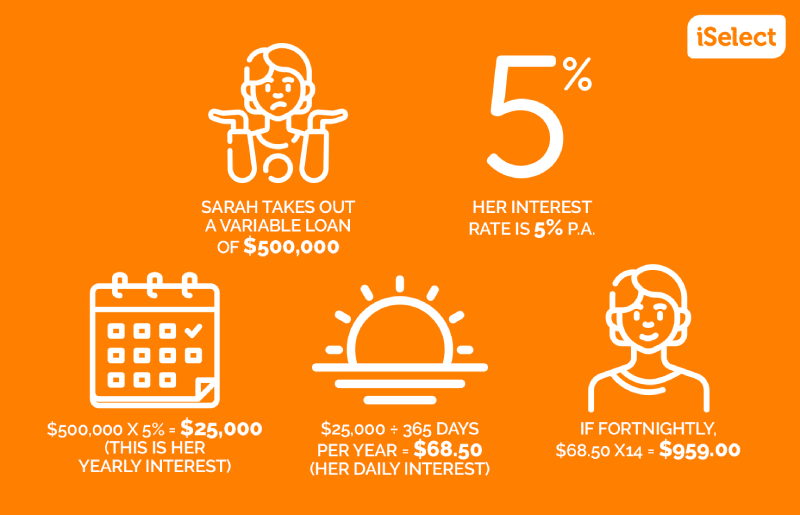

To calculate how much your interest payments will be, your lender takes the amount of your loan and multiplies it by your interest rate. That gives them the interest you’ll pay in a whole year, so they divide that number by 365 to work out the daily amount.

If you like formulas (and who doesn’t?), here’s what it looks like:

(principal x rate) ÷ time = interest

It can be a bit confusing but there’s some pretty easy steps involved:

Remember that this is only to calculate the interest. If Sarah’s loan is principal and interest, she’ll be paying that fortnightly $958.90 on top of whatever her principal repayment is.

How can I reduce my interest?

As you’ve already learned, interest rates are determined by many factors beyond your control. The most obvious step you can take to try and get a lower rate is to shop around and compare different lenders and loan types. We’ve partnered with Lendi to make comparing Home Loans easier for iSelect customers.

If you already have a loan, you can try negotiating a slightly lower rate.

If you already have the lowest interest rate you can find, there are also steps you can take to reduce the amount of interest you pay over the lifetime of your loan.

Here’s what you can do:

Reduce your loan amount

Your interest is calculated on the principal of your loan. Reduce the principal, reduce your interest repayments. Taking out a principal and interest loan, rather than an interest only loan will help you do this. Getting a Home Loan that allows you to make extra repayments, or with redraw or offset facilities, can help you pay down your loan balance sooner, possibly saving you thousands of dollars in interest repayments.

Shortening your loan length

Slow and steady might win the race, but when it comes to your Home Loan, slower also means more interest repayments. A longer loan might mean smaller monthly repayments, but you can wind up paying thousands more in interest. Of course, you have to be realistic about what you can manage. If you opt for a shorter loan to save on interest in the long term but end up in financial stress in the short term, is it really the best option for you?

Repaying more frequently

Did you know that if you switch to more frequent repayments, you’ll end up paying less, even if you don’t pay any extra towards your loan? It’s not magic, it’s maths. Here’s how it works.

Most lenders will automatically set up your loan so you make monthly repayments but will allow you to switch to fortnightly or weekly repayments if you ask. Here’s where the maths magic comes in. i.e. 26 fortnightly repayments of $1,000 ($26,000) equals more than 12 monthly repayments of $2,000 ($24,000). Voila, you’ve paid off $2000 more without (hopefully) noticing!

Choosing an offset account

Many loans come with the option of an offset account, but what are they and how can you use them to reduce your interest payments?

An offset account is like an everyday bank account that’s linked to your Home Loan. It comes with all the functionality of a transaction account, which means you can get your salary paid directly into it and instantly transfer money in and out as often as you like. But here’s the best part. It’s linked to your Home Loan account, and however much money is in there is deducted from the principal when your monthly interest is calculated.

Let’s say you have a $500,000 Home Loan. If you have $30,000 in savings that you keep in your linked offset account, your interest will be calculated on $470,000 instead of the full amount!

Helpful tip:

Did you know you can call your bank and try to negotiate a better interest rate on your loan? If you’ve been a loyal customer and they have a lower rate for new customers – try asking for that. Even better if you’ve found a lower rate at a different lender. They might give it to you to keep you as a customer. If you’re not confident, you can ask your broker to make the call for you.

Where can I compare Home Loans?

It could pay off to put in the time and effort to compare interest rates. Make sure you compare the overall cost of the loan, including interest and fees. Lenders are required to list a comparison rate that shows both.

The good news is that you don’t have to tackle it alone. At iSelect we’ve partnered with Lendi to make the process of comparing Home Loans easier for iSelect customers to compare Home Loans using our online tool.

Get started on comparing home loans today!*

Find a home loan by comparing with iSelect’s trusted partner, Lendi.

*iSelect is the trading name of iSelect Mortgages Pty Ltd (ABN 86 148 217 181). iSelect Mortgages Pty Ltd is a credit representative (Credit Representative 400540) of Auscred Services Pty Ltd (Australian Credit Licence 442372). iSelect provides a referral to Lendi Pty Ltd, a Credit Representative of Lendi Group Finance Pty Ltd (Australian Credit License 442372). iSelect Mortgages Pty Ltd receives a commission from the Licensee for each new customer account created and for each home loan submitted through this service.

.svg)