Understanding the Health Insurance Claim Process

Understanding the Health Insurance Claim Process

Compare Health Insurance Policies

Save time and effort by comparing a range of Australia’s health funds with iSelect

When should I make a claim?

What can I claim on Private Health Insurance?

How do I make a claim?

What details will I need to provide when making a claim?

What happens after I submit my claim?

What happens if my claim is rejected?

Where can I find and compare Health Insurance?

If you’ve ever been to the optometrist, dentist, or visited another type of medical professional or specialist, then you may have been asked if you have Private Health Insurance or Extras Cover.

While it might initially sound like a total snooze-fest, having Private Health Insurance could actually be an incredibly helpful and cost-effective way to manage your medical bills.

However, in order to get any money back from your Health Fund, you’ll need to ensure the service used is covered under your Policy and make a claim. Basically, making a claim is the process of contacting your Private Health Insurer about the health or medical service you accessed in order to receive a rebate (or money back) from them.

Having Health Insurance can help take the sting out of a pricey medical or health treatment bill by covering some (or all) of the cost. Ka-ching!

When should I make a claim?

You should generally make a claim as soon as you have all the information you need for the service you accessed.1Understanding Insurance – Understanding claims

It’s also a good idea to read through your Health Insurance policy documents to understand any claim deadlines or time limits that you need to be aware of before making any claims. You don’t want to miss out!

What can I claim on Private Health Insurance?

Private Health Insurance is generally divided into three categories: Hospital, Extras, and Ambulance Cover (if your state or territory doesn’t already provide it for you).2Australian Government Department of Health and Aged Care – What private health insurance covers

Let’s take a look at what can be included under these different types of cover.

Hospital Cover

Hospital Cover insures you against all or part of the treatment costs as a private patient in either a public or private hospital, including doctors’ fees and hospital accommodation.3Australian Government Department of Health and Aged Care – Hospital cover and product tiers Private Hospital Cover can allow you to:4Commonwealth Ombudsman of Private Health Insurance – What is covered by private health insurance?

- Skip public waiting lists at participating private hospitals

- Choose which hospital you receive your treatment at

- Choose the doctor or specialist who performs the treatment

What you’re covered for will depend on your level of cover, your insurance provider, and your policy.5As above. As with most things in life, the more you pay for your policy, the more things you’ll likely be covered for.6As above.

In general, basic treatment for in-hospital procedures list on the Medicare Benefits Schedule (or MBS) will be covered up to the MBS fee,7As above. with different policies coming with different exclusions and restrictions.8As above.

Extras Cover

Extras Cover, also known as general treatment or ancillaries cover, insures you against all or part of the cost of out-of-hospital health and wellbeing treatments that generally aren’t funded by Medicare.9As above. The services you’re covered for will depend on your policy and may include treatments like:10As above.

- Dental services

- Chiropractic treatment

- Podiatry

- Physiotherapy

- Occupational and speech therapy

- Glasses and contact lenses

In most cases, Extras Cover isn’t unlimited, so you’ll find the amount you can claim per service, per year or over the lifetime of your policy is capped.11As above. It’s also worth noting that some services may not be covered by your policy at all. Again, the more you spend on a policy, the more bells and whistles it’s likely to come with.

Ambulance Cover

Ambulance Cover is often included as part of your Hospital or Extras policy.12As above.

The level of cover can differ depending on the policy you choose and the state you live in.13As above In some cases, and depending on which state you live in, ambulance costs are covered by your state government.14Australian Government Department of Health and Aged Care – Ambulance

How do I make a claim?

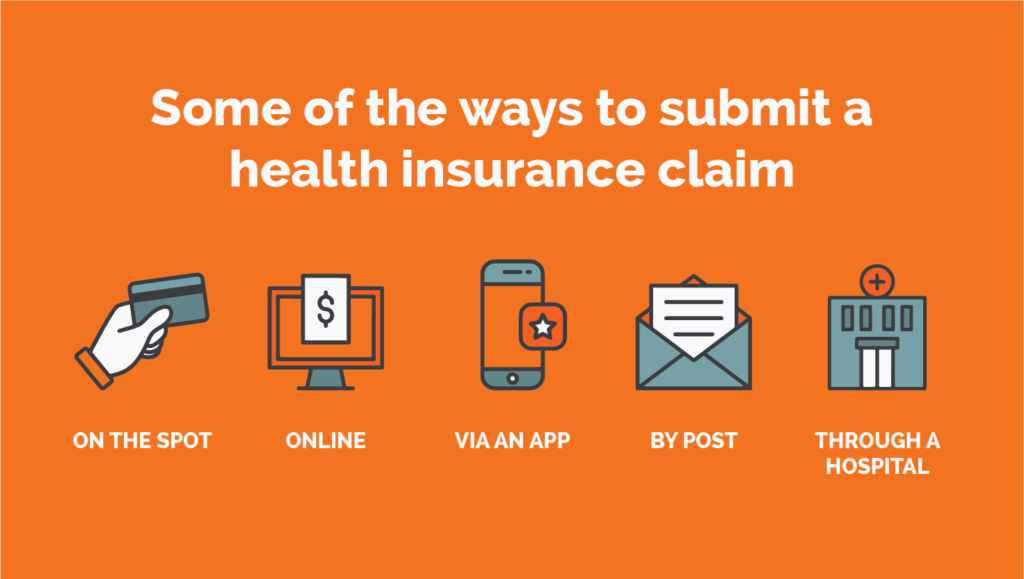

There are many ways to lodge a claim through your Health Insurance policy. The available options for your claim will depend on your Health Insurance fund, and the type of claim you’re making.

Here are some of the ways you can make a Health Insurance claim:

On the spot

If a healthcare provider has a device called a HICAPS machine, you’ll simply need to swipe your health fund membership card when paying for the service.15HICAPS – About HICAPS

Your rebate is automatically deducted from the provider’s fee, so you’ll only be charged the difference between that fee and the amount covered by your policy for the service (also known as the ‘gap’).

The great news is that 100% of Private Health funds use the HICAPS system, making claiming on the spot really easy.

Online

With most funds, you can lodge a claim directly through their website, but it’s likely you’ll first need to set up an online account.

When you’re ready to make a claim, simply log in and follow the steps from your insurer to lodge. It’s a pretty breezy process from there!

Depending on your insurer, you may need to lodge the healthcare provider’s number, item code and amount you paid for the service, but you may also be required to upload your accounts and receipts (taking a photo of them is usually fine), so hold onto any paperwork you’re given. And as always, ask your insurer if you’re unsure!

Via an app

Some health insurers may offer a dedicated app which you can use to submit your claim making the process super simple! This works in a similar way to lodging your claim online, but in this case, you can download your health insurer’s app on your smartphone, login to your member account, and away you go! It also makes it super easy to upload photos of doctors receipts etc.

By post or in person

If the above methods don’t tickle your fancy, you can always print out your claim forms and post them or go in person to your insurer’s closest customer service centre (if there’s one nearby – not all funds have physical locations).

Just make sure to include the original receipts and an itemised account of the services you accessed. Then, you might need to wait for a couple of weeks (or sooner, depending on your health funds abilities) for your rebate amount to be refunded into your nominated bank account.

What details will I need to provide when making a claim?

Hospital Cover

It’s likely that your health fund will have a claim form for you to fill out and submit when lodging your claim. These forms may be available in PDF format on your health fund’s website, which you can download and print. The form might look something like this one here.

If your Health Fund doesn’t provide a claim form, then you may be able to get one from the hospital or day facility where you received your hospital treatment.16Bupa – How to make a Hospital Claim

And of course, don’t forget to provide an official, itemised receipt, which the hospital can provide to you.17As above.

Extras Cover

Making a claim for Extras Cover is generally easy and breezy. As we mentioned earlier, you can make your Extras claim either on the spot using the HICAPS machine, through your health fund’s app, or online through your health fund’s website.18TUH – How do I make a claim on my Extras Cover?

- On the spot

If you’re paying on the spot, all you need to bring is your health fund membership card! You can simply swipe it through the HICAPS machine after your treatment and your claim will be processed straight away!19As above.

- Mobile app

If you’re claiming through your health fund’s mobile app, then you may be able to do so by simply taking some photos of your receipts and uploading them to the app.20As above. Make sure you have the following details on your receipt before you lodge your claim:21As above.

- Your provider’s name

- Your provider’s number

- Your provider’s practice address

- Your provider’s ABN/ACN

- The date of service

- A description of the service

- The name of the patient and the cost

And don’t leave it too long! Your itemised receipt can be claimed no more than two years from the date of service!22Australian Unity – How to claim on Health Insurance

- Online

Claiming online through your health fund’s member portal is simple, just log in and submit your claim. We recommend holding onto any invoices or receipts just in case your health fund needs any more info.23As above.

Ambulance Cover

In some cases, you won’t receive a bill for your emergency ambulance service, as your health fund will generally liaise with your state or territory’s ambulance provider.24Nib – Emergency ambulance claiming

It’s also a good idea to check whether ambulance services in your state or territory are provided under a state scheme. For example, this is the case in Queensland and Tasmania, so if you live in either of those states, you aren’t required to pay a bill for ambulance services.25As above.

If you do need to make a claim, you may be able to login to your health fund member account and upload a photo or scanned copy of your invoice.26Ahm – How do I make an Ambulance claim?

Then, your health fund will assess your claim and get back to you with an outcome.27As above.

If you have already paid for your ambulance service, then you’ll need to include proof of payment, too.28As above.

What happens after I submit my claim?

Once you submit your claim, you may need to wait a few days or a couple of weeks for your health fund to assess it before they reimburse you for any refunds or rebates. This time frame can vary from health fund to health fund, so check their website or give them a call and ask exactly how long it will take for them to process your claim.

Your health fund will check the following things when assessing your claim:29Nib – How is a Health Insurance claim assessed?

- That your policy covers the treatment or service you’re claiming for.

- That you were covered for the date of the treatment.

- That the provider or specialist you visited is registered and recognised by Australian Health Practitioner Regulation Agency (APRA).

- That you haven’t reached your annual policy limits (some policies have a cap on how much you can claim each calendar year per treatment, or per service.)

While you’re waiting, keep in mind that some claims can be more complicated than others.

For example, if your claim is for preventative health, orthotics, or TENS machines, it’s possible that your health fund may ask you to provide additional documentation to support your claim.30Australian Unity – How to claim on Health Insurance If this is the case for you, and your claim has been delayed because your health fund wants more information, don’t fret! Get in touch with your service provider and they should be able to help you with any additional documentation required.

What happens if my claim is rejected?

A rejected claim isn’t great news, is it? Unfortunately, it can happen, and there are many reasons why. Here are a few possibilities:31Nib – How is a Health Insurance claim assessed?

- Your health fund doesn’t cover the service.

- There’s some missing information on the receipt (oops!).

- The service isn’t included on your level of cover.

- The photo of your receipt was too blurry.

- The service is covered by Medicare (which means you should go to Medicare!)

If your claim was rejected and none of the above reasons apply to you, then it may be time to contact your health fund for an explanation.

You never know, it could be something as small as an administrative error! Whatever the case may be, it’s best to get in touch with your health fund as soon as you can to resolve the issue.

If you aren’t given a satisfactory response, you may need to escalate it further with your health fund by contacting their customer service team to let them know you’d like to lodge a complaint.

If you’re still unhappy with the outcome of your complaint, you may choose to lodge a dispute with the Commonwealth Ombudsman.32Commonwealth Ombudsman – Health Insurance Complaints

Where can I find and compare Health Insurance?

Private Health Insurance offers the peace of mind that you’re covered for healthcare services when you need them (and may not be able to otherwise afford). What’s more, if you earn over a certain amount of money, you may have to pay the Medicare Levy Surcharge if you don’t have private hospital cover.33Australian Taxation Office – Paying the Medicare levy surcharge

iSelect makes it easy for you to compare health funds and to help find a policy that’s suitable for you.* To find out more about choosing a Health Insurance policy, contact our friendly team on 1800 784 772.

WE’RE HERE TO HELP

Need help with health insurance?

We can help you find a suitbable product for your needs

Health Insurance & Tax

Tax Implications on Health Insurance

About the Medicare Levy Surcharge

About the Life Time Health Cover Loading

Government Rebate & Means Testing

.svg)