What Is A Medicare Claim?

What Is A Medicare Claim?

Compare Health Insurance Policies

Save time and effort by comparing a range of Australia’s health funds with iSelect

How can I make a Medicare claim?

Does Medicare cover any dental expenses?

How long does it take to process a Medicare claim?

What if I have unclaimed Medicare rebates?

What is meant by ‘cost to claimant’?

Gap cover

Where can I compare Health Insurance policies?

Medicare covers General Practitioner (GP), specialist and hospital services.

Between April 2022 to March 2023, Australian patients accessed a total of $459 million in GP, specialist and hospital services, at a cost in Medicare benefits of $27 billion.1Australian Government Department of Health and Aged Care – Medicare Annual Statistics – Rolling 12 months (July 2009 to March 2023).

Of those services, the average patient contribution for out-of-hospital services was $74.58 in out-of-pocket costs.2As above.

How can I make a Medicare claim?

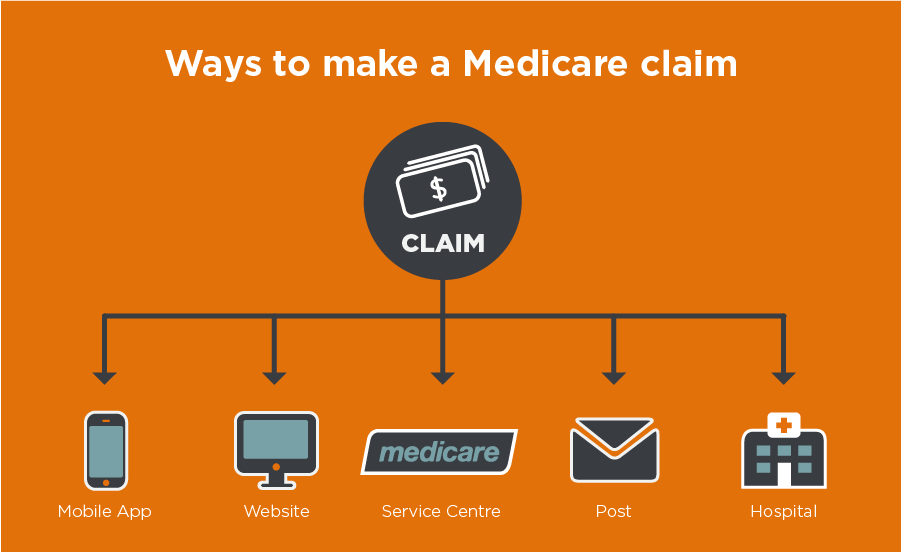

There are several ways to claim on Medicare. We’ll start with the quickest and easiest.

At the doctor

Many healthcare services can be accessed at no cost. This is known as bulk billing, and it can cover things like visits to GPs and some specialists, tests and scans such as x-rays and pathology tests, and eye tests with an optometrist.3Services Australia – Bulk billing

However, most doctors set their fees higher than the amount covered by Medicare which means you will incur some out-of-pocket cost. In this scenario, you generally pay the higher fee and then claim back the portion of your rebate immediately while still at their office, via an EFTPOS machine or other secure connection. The Medicare benefit payment will then be made back to either your EFTPOS card or nominated bank account.

If your doctor doesn’t offer electronic claiming, there are three other ways to claim: mobile, online, and by mail.

Express plus Medicare mobile app

The newest payment option is to use the Express Plus Medicare mobile app, available on iOS and Android phones.

To download the app, first check that you have a myGov account linked to Medicare, which is what will create your Medicare online account. Then go ahead and download the app from your app store.

Through the app you can submit claims for most services, view your Medicare safety net balance, change your bank details, or order a replacement Medicare card.

Medicare online account

Most Medicare claims can be made online, with the exception of any services provided over 2 years ago. To claim online, you must register a Medicare online account via myGov.

More information can be found here.

By mail

If you’re unable to use the mobile app or an online account, there’s always the option of submitting a Medicare claim form by post. Fill out this form and mail it to Medicare at the postal address listed on the form. However, it’ll probably take a little bit longer for Medicare to process your claim this way compared to submitting a claim online or in the app.

At a Medicare Service Centre

You can also make a claim at a Medicare Service Centre. Your local Service Centre will provide you with a claim form to fill out, and leave in their on-site dropbox. Forms are then transferred off-site for processing. Claiming this way will take longer for your claim to process than other methods.

Does Medicare cover any dental expenses?

While a limited amount of dental treatment is provided to children of families receiving certain government benefits, and some adult concession card holders, you can’t submit a Medicare claim for most dental examinations and treatments.4Health Direct – Cost of dental care

Taking out a Private Health Insurance policy that includes Extras Cover could help you cover some of the cost for various dental treatments. These may include, but aren’t limited to services such as: check-ups, cleanings, x-rays, fillings, extractions, crowns, bridges, dentures, orthodontics, root canals, and treatment of gum disease.

The range of benefits offered and paid, and the number of times you can claim, will typically vary widely between health funds and policies.

How long does it take to process a Medicare claim?

The amount of time it takes to process a claim varies, but below is a general guideline depending on which method is used to submit a claim:5Australian Government, Services Australia – Medicare Claims

| Medicare claim method | Processing time |

|---|---|

| At your doctor’s (GP’s) office after your appointment | On the spot to your nominated EFTPOS/debit card. |

| Medicare Online account | 7 days |

| Express Plus Medicare app | 7 days |

| 28 days | |

| Medicare Service Centre | 28 days |

What if I have unclaimed Medicare rebates?

Claim them now, if they are less than 2 years old! Unfortunately Medicare will not accept claims for services that are older than 2 years,6As above. so it’s best to submit a claim as soon as you can after you receive a service or treatment under the Medicare Benefits Schedule.

What is meant by ‘cost to claimant’?

To clarify, a claimant is the person who incurs the medical expense for a service.

A ‘cost to claimant’ would be the out-of-pocket expense you would need to pay for certain services.

Under the Medicare Benefits Schedule, Medicare pays 85% of the schedule fee for a specialist, and 100% for a GP.7Australian Government Department of Health and Aged Care – Medicare Costs But remember, many GPs and specialists charge above the scheduled fee which is why you’ll often end up having to cover some of the cost yourself.

Gap cover

The difference between what is covered by the Medicare Benefit Scheme (MBS) and what you pay at a doctor or specialist is called the ‘gap’.8Commonwealth Ombudsman of Private Health Insurance – Out of pocket costs

While Private Health Insurance can’t help cover the gap when it comes to out-of-hospital services such as the GP office, Private Health Insurance may be able to help you avoid paying a gap when it comes to in-hospital treatments and services.

You may be able to avoid paying a gap if you have Private Health Insurance and your fund as a No Gap’ scheme with your chosen doctor and hospital.

Speak to your preferred doctor or specialist before receiving treatment, to check that they participate in the medical gap scheme with your private health insurer.

Where can I compare Health Insurance policies?

Find out more about how you can be covered with Private Health Insurance by calling iSelect on 1800 784 772.

Compare health insurance policies the easy way

Save time and effort by comparing a range of Australia’s health funds with iSelect

WE’RE HERE TO HELP

Need help with health insurance?

We can help you find a suitbable product for your needs

Health Insurance & Tax

Tax Implications on Health Insurance

About the Medicare Levy Surcharge

About the Life Time Health Cover Loading

Government Rebate & Means Testing

.svg)