What Is the Medical Gap Scheme?

What Is the Medical Gap Scheme?

Compare Health Insurance Policies

Save time and effort by comparing a range of Australia’s health funds with iSelect

What is a medical gap?

How will I know if I have to pay a medical gap?

How do I avoid paying the medical gap?

What kind of gap cover can I get?

What happens if I don’t have gap cover?

Why does the medical gap exist?

Where can I find and compare Health Insurance?

What is a medical gap?

Medical gaps can be pretty expensive, even if you already have Private Health Insurance. Unfortunately, they can also be pretty confusing for anyone who doesn’t speak fluent jargon. So, let’s start by breaking down how private healthcare works.

When you get treated at a private hospital, the Australian Government helps cover the costs. They pay a standard fee for a whole range of treatments on the Medicare Benefits Schedule (MBS). It usually happens like this:

- Medicare pays 75% of the MBS fee1Australian Government | Department of Health and Aged Care – Medicare costs

- Your insurer pays 25% of the MBS fee2As above

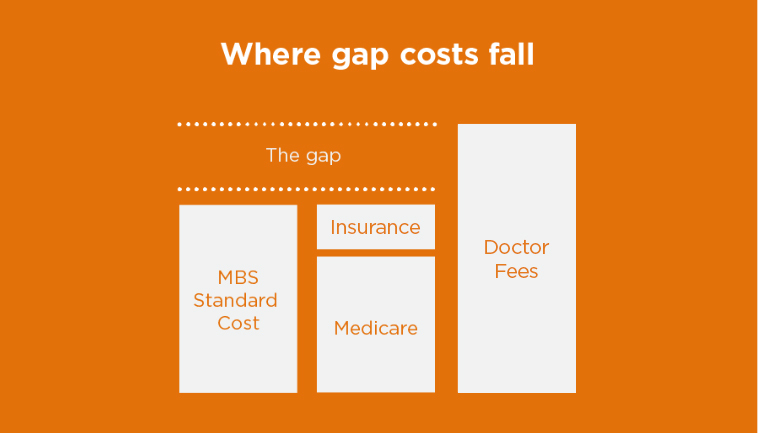

However, doctors can choose to charge more than 100% of the standard MBS fee. If this happens, you might end up paying quite a bit from your own pocket—on top of all those insurance premiums, too! This extra amount is called a ‘medical gap’ because it’s a gap your insurance policy might not cover.3Commonwealth Ombudsman – Choosing a Health Insurance Policy

How will I know if I have to pay a medical gap?

Let’s start with the easy way. Talk to your doctor and ask them about all the costs involved before your treatment begins. They can give you a written estimate of all the costs involved.4Australian Government | Department of Health and Aged Care – Out of pocket costs

This estimate may include a list of all the MBS items for your treatments and how much the doctor will charge for each of them. You can also look up the standard fees for these treatments on MBS Online.5Australian Government | Department of Health and Aged Care – MBS Online If the doctor charges more than any of the standard fees listed, then you might end up paying the medical gap for these treatments.

How do I avoid paying the medical gap?

This is where good Hospital Cover can help. Many insurers offer a medical gap scheme (also called ‘gap cover’) that can reduce your out-of-pocket expenses. In some cases, you might even be able to avoid the medical gap altogether!

It works like this: most insurers have special agreements with certain doctors, specialists and hospitals.6Australian Competition & Consumer Commission – Private health insurance These are their preferred providers. Depending on what kind of agreement they have with your insurer, these providers will either charge no gaps or a limited gap amount.

So don’t forget to ask your doctor if they participate in your insurer’s gap scheme. It’s up to them whether they’ll accept your gap cover, so it’s best to get a clear answer before any treatment starts.7PrivateHealth.gov.au – Gap cover doctors That way, you can sidestep any nasty surprises and keep your budget intact.

What kind of gap cover can I get?

This honestly depends on your insurer. Some insurers bat way above their average and have ‘no gap’ arrangements with more than 90% of their preferred providers.8Private Health Insurance Ombudsman – State of The Health Funds Report 2020 (Page 20-21) Others are much better at limiting how much you’ll pay in medical gaps for different treatments.

It’s all based on what kind of agreement the doctor or hospital has in place with your insurer. Whenever you’re eligible for gap cover, it usually comes in one of the two forms.

1. No gap cover

This usually involves no extra fees on your medical treatments. Under these agreements, your insurer pays more than the standard amount on an MBS fee.

However, they’ll usually have a gap limit: a maximum amount that they’ll pay. So long as the doctor charges more than the MBS fee but less than the gap limit, you’ll be covered with no extra fees to pay.9Australian Government | Department of Health and Aged Care – Out of pocket costs

Example

Tim’s been a chippie for many years, but all that hard work has taken a toll on his back. Now he needs a simple procedure to get one of his vertebrae fixed and he’s decided to get it done at a private hospital.

The standard MBS fee for this treatment is $838.35.10Australian Government | Department of Health and Aged Care – MBS Online | Item 51020 But his doctor has let him know it’s going to cost $1200.00—that’s $361.65 extra!

Fortunately, the hospital has a no gap arrangement with Tim’s insurer. His gap limit is also $400 which covers the extra amount. As a result, Tim doesn’t have to pay any additional fees for his medical treatment, he only had to pay his hospital excess. Nice one, Tim!

2. Known gap cover

If your doctor participates in a ‘known gap’ scheme, then you’ll have some out-of-pocket expenses for each procedure they perform.

This is because your doctor charges more than the gap limit. However, they have also agreed to keep this amount below a certain threshold, which will be communicated with you.11Australian Government | Department of Health and Aged Care – Out of pocket costs That’s why they call it a known gap.

Example

Sammy is in dire need of some dental surgery. She’s got an erupted tooth and needs it removed pronto. Her preference here is a cosy little private hospital.

The standard MBS fee here is $180.45.12Australian Government | Department of Health and Aged Care – MBS Online | Item 75400 Her hospital charges extra for the procedure, but they also have a known gap agreement with her insurer where they won’t charge more than $280.45.

All up, Sammy has a known medical gap of $100.00. Her Medicare and private insurer will pay the rest.

What happens if I don’t have gap cover?

If your doctor or your specialist doesn’t participate in your insurer’s gap scheme, then you’re going to need to pay the medical gap yourself.

But here’s the silver lining: Medicare will cover part of your fee. And your insurer will also pay 25% of the standard MBS fee—so long as you’re covered for the treatments. It’s just those extra treatment charges you’ll need to pay.

Why does the medical gap exist?

Australia is lucky enough to have universal health care in the form of Medicare.13Australian Government | Department of Health and Aged Care – The Australian health system This means that public patients in a public hospital won’t usually have any out-of-pocket expenses.14Australian Government | Department of Health and Aged Care – Out of pocket costs It’s a pretty sweet deal, honestly!

However, most private hospitals and clinics aren’t owned by the government. They’re private businesses and they’re legally allowed to set their own prices.15Australian Government | Department of Health and Aged Care – Medical Services Advisory Committee | What is the MBS and Medicare?

So, while Medicare sets a standard fee for most treatments, doctors and private hospitals can still charge what they like. It would also make public healthcare a lot more expensive to fund if Medicare had to fill in every medical gap that private hospitals charge.

Where can I find and compare Health Insurance?

Finding Health Insurance with great gap cover doesn’t need to involve hours of research and deciphering the nitty gritty. Instead, you can compare a whole range of policies from different providers with iSelect!* Get started today with our online comparison tool or give our friendly team a call on 1800 784 772.

WE’RE HERE TO HELP

Need help with health insurance?

We can help you find a suitbable product for your needs

Health Insurance & Tax

Tax Implications on Health Insurance

About the Medicare Levy Surcharge

About the Life Time Health Cover Loading

Government Rebate & Means Testing

.svg)