What Is The Medicare Safety Net?

What Is The Medicare Safety Net?

Compare Health Insurance Policies

Save time and effort by comparing a range of Australia’s health funds with iSelect

What services does the Medicare Safety Net cover?

How are Medicare benefits calculated and paid?

What are the types of Medicare Safety Nets?

What is an EMSN benefit cap?

What are the types of Medicare Safety Net thresholds?

2023 MSN thresholds

Do I have to register to be eligible for the Medicare Safety Net?

How do I check my Medicare Safety Net balance?

Is prescription medication covered under the MSN?

Comfortable with your cover?

The Medicare Safety Net is a scheme that can help you reduce your out-of-pocket medical costs for out-of-hospital services, such as seeing a doctor or specialist, or some types of tests and scans such as CT scans and blood tests.1Services Australia – Medicare Safety Nets

If you or your family have a lot of doctor and specialist visits in a single calendar year, once you’ve reached the threshold (spent a certain amount), you may be entitled to get more back from Medicare, even though your doctor’s costs will stay the same.2Services Australia – Medicare Safety Nets

What services does the Medicare Safety Net cover?

The MSN applies to out-of-hospital Medicare services and tests listed under the Medicare Benefits Schedule (MBS).

It’s important to talk to your doctor before your consultation or treatment to confirm if it’s considered an out-of-hospital service under the MBS.

For example, if you undergo a procedure as day surgery, it may be considered hospital treatment. Avoid any nasty invoice surprises and ask the question about coverage and gap fees before you go ahead.3Australian Government Department of Health and Aged Care – Medicare Safety Net Arrangements, 1 January 2023.

How are Medicare benefits calculated and paid?

Every service eligible for a Medicare rebate is listed on the Medicare Benefits Schedule (MBS), with a set scheduled fee amount.

Medicare pays a proportion of the scheduled fee, and you’re responsible for the difference. If your doctor or specialist charges a higher fee than the total MBS fee, the difference is known as the ‘gap’ and you’re required to pay it.

This ‘gap’ affects how the different types of Safety Nets and thresholds work.

What are the types of Medicare Safety Nets?

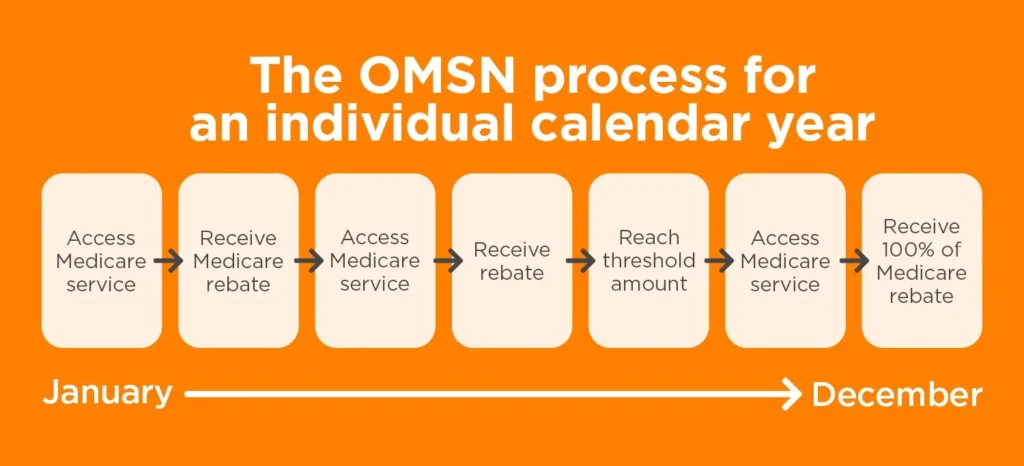

1. Original Medicare Safety Net (OMSN)

If you’re enrolled in Medicare, you will get back 100% of the scheduled fee for your doctor or specialist visit after you have reached the OMSN threshold – that is, once you have already spent more than the threshold amount in a single calendar year.4Services Australia – Original Medicare Safety Net

If you’re single, you will automatically receive the 100% benefit when you reach the threshold5Services Australia – Original Medicare Safety Net while families and couples can register as a family which combines all your costs and means you are more likely to reach the threshold sooner.6Services Australia – Medicare Safety Nets, How to register

The ‘gap’ between the MBS schedule fee and benefit paid by Medicare is how your threshold amount is calculated throughout the year – not by the total of the fees you pay.

When you’re eligible for the OMSN, you receive a Medicare benefit of 85% – 100%7Services Australia – Medicare Safety Nets, How They Work of the scheduled fee, and 100% of the scheduled fee for bulk-billing GP consultations.8Services Australia – Bulk Billing

2. Extended Medicare Safety Net (EMSN)

The EMSN provides extra benefits for families and singles with high out-of-pocket medical costs.9Services Australia – Extended Medicare Safety Net

When you reach the general threshold, your benefit will apply to out-of-hospital medical services for the rest of the calendar year.

You’ll get the Medicare benefit and the lowest of either:10Services Australia – Extended Medicare Safety Net

- 80% of the out-of-pocket amount

- EMSN benefit caps

For 2023, the EMSN thresholds are:11Australian Government Department of Health and Aged Care – Medicare Benefits Schedule – Note GN.10.27

- $770.30 for people who have a concession card or get Family Tax Benefit Part A

- $2,414 for others.

You may also be eligible for a lower threshold if you:12Services Australia – Extended Medicare Safety Net

- are a Commonwealth Seniors Health Card holder

- a Health Care Card holder

- a Pensioner Concession Card holder

- Are eligible for Family Tax Benefit Part A.

What is an EMSN benefit cap?

Some services are capped with a limit on how much you can be reimbursed by Medicare.

When you reach the EMSN threshold, benefits for capped items are 80% of your out-of-pocket cost. If the out-of-pocket cost is higher than the EMSN benefit cap, you receive the smaller benefit amount (the EMSN benefit cap).13Australian Government Department of Health and Aged Care – Medicare Benefits Schedule – Note GN 10.27

An EMSN benefit cap example14As above. Medicare Benefits Schedule – Note GN 10.27

If Mandy sees the doctor to get x-rays on her broken leg, there will be a schedule fee of $100, and the out-of-hospital benefit is $85 (85% of the schedule fee). The EMSN benefit cap is $30.

Assuming that Mandy has reached the EMSN threshold, let’s look at this scenario with a $125 schedule fee:

| Item | Schedule fee | Out-of-hospital benefit | EMSN benefit cap |

|---|---|---|---|

| X-rays for broken leg | $125 | $85 | $30 |

Assuming Mandy has reached the EMSN threshold, if the fee charged by the doctor for her x-rays is $125, the standard Medicare rebate is $85, with an out-of-pocket cost of $40.

The EMSN benefit is calculated as: $40 x 80% = $32.

However, as the EMSN benefit cap is $30, only $30 will be paid.

What are the types of Medicare Safety Net thresholds?

Three different thresholds (how much you need to have been left out of pocket or paid in ‘gap fees’ before receiving a higher Medicare benefit for services) apply to match the different types of Medicare Safety Nets.

2023 MSN thresholds

Different MSN thresholds apply depending on your circumstances, income and which type of MSN you’re eligible for:15Services Australia – What Are The Thresholds

- OMSN

- EMSN – General

- EMSN – Concessional and Family Tax Benefit (FTB) Part A

Service Australia’s Threshold Amounts for Medicare Safety Nets

| Threshold | Threshold amount | Who it’s for | What counts towards the threshold | What benefit you’ll get |

|---|---|---|---|---|

| OMSN | $531.70 | Everyone in Medicare | Your gap amount for the calendar year | 100% of the schedule fee for out-of-hospital services. |

| EMSN (General) | $2414 | Everyone in Medicare | Your out-of-pocket amount for the calendar year | 80% of out-of-pocket costs or the EMSN benefit caps for out-of-hospital services. |

| EMSN – Concessional and FTB Part A | $770.30 | Concession card holders and families eligible for FTB Part A | Your out-of-pocket amount for the calendar year | 80% of out-of-pocket costs or the EMSN benefits caps for out-of-hospital services. |

Source: Services Australia

Do I have to register to be eligible for the Medicare Safety Net?

No, not if you’re single. Medicare keeps track of your claims throughout the year. If you’re single, have no dependents, and enrolled in the Medicare system, you don’t have to register for the Safety Net.16Services Australia – Medicare Safety Nets, How To Register, Individuals Your higher benefits will be applied automatically if you reach the threshold.

However, couples and families must register as a Medicare Safety Net family, even if you’re already listed together on the same Medicare card.17As above. This means your medical costs are combined so you reach the threshold and receive higher benefits sooner.

You can register as a family if you’re a married or de facto couple (with or without dependent children), or a single person with dependent children.18Services Australia – Medicare Safety Nets, How To Register, Families and Couples, Families and Dependents

Families are notified if they’re close to reaching the threshold. You can then confirm your family members with Medicare to receive the higher benefit when you reach the threshold.

How do I check my Medicare Safety Net balance?

Log in to your Medicare account online via your myGov account, or use the Express Plus Medicare mobile app for instant access to your Safety Net balance and claims history.

Is prescription medication covered under the MSN?

No, the costs of many prescription medications are covered under the Pharmaceutical Benefits Scheme (PBS).

Under the PBS, the Australian Government subsidises the cost of medicine for most medical conditions, which means you can have access to a wide range of medication without paying full price for them.19Services Australia –Pharmaceutical Benefits Scheme

To buy PBS medication from a pharmacist, you’ll need a doctor’s prescription. Your pharmacist can tell you if your medicine is cheaper under the PBS.

Comfortable with your cover?

For the right mix of Medicare benefits and private health insurance peace of mind, start comparing a range of policies and providers online today, or call us on 1800 784 772.

WE’RE HERE TO HELP

Need help with health insurance?

We can help you find a suitbable product for your needs

Health Insurance & Tax

Tax Implications on Health Insurance

About the Medicare Levy Surcharge

About the Life Time Health Cover Loading

Government Rebate & Means Testing

.svg)