How To Lock In Your Health Insurance Premiums Early

How To Lock In Your Health Insurance Premiums Early

Compare Health Insurance Policies

Save time and effort by comparing a range of Australia’s health funds with iSelect

How do I lock in my premium?

When is the best time to lock in my premium?

What are the benefits of locking in my premium?

Are there any other ways I can save on my premium?

Where can I compare Health Insurance policies?

Here’s the deal: The Aussie Government does its thing and bumps up Health Insurance premiums every 1 April (and unfortunately, it’s not an April Fool’s Day joke). But here’s the hack – if you get in before April, lots of those Private Health Insurance peeps let you pay for a whole year or more up-front at the previous year’s rate!

If you can swing it, think about getting ahead of the game and dropping that full 12-month (or sometimes 18-month) payment to save the pain of a price hike down the road.

How do I lock in my premium?

Bagging a sweet deal by locking in your premium is like winning the insurance game, but not every insurer is necessarily in on the secret sauce. Give your insurer a shout to see if you can lock in that lower rate on your policy.

Now, mark this on your calendar – the Health Insurance premium increase is an annual tradition, dropping on 1 April. To skip the increase for the year, you’ve gotta be a step ahead. Drop the whole year’s premium in March, right before the prices take a leap.

To lock in that golden premium:

- Your policy needs to kick off before 1 April.

- Your bank needs to process that annual payment before the big day – and some insurers want it a few days earlier. You’ll also want to take your bank’s processing time into account.

When is the best time to lock in my premium?

If you want to play it smart and lock in those premiums, don’t wait until the April frenzy. Get on it well before! Early to mid March is your golden window. Start off March with a friendly chat with your insurer to nail down the exact date. But remember, you can seal the deal up to a few days before the April curtain rises.

What are the benefits of locking in my premium?

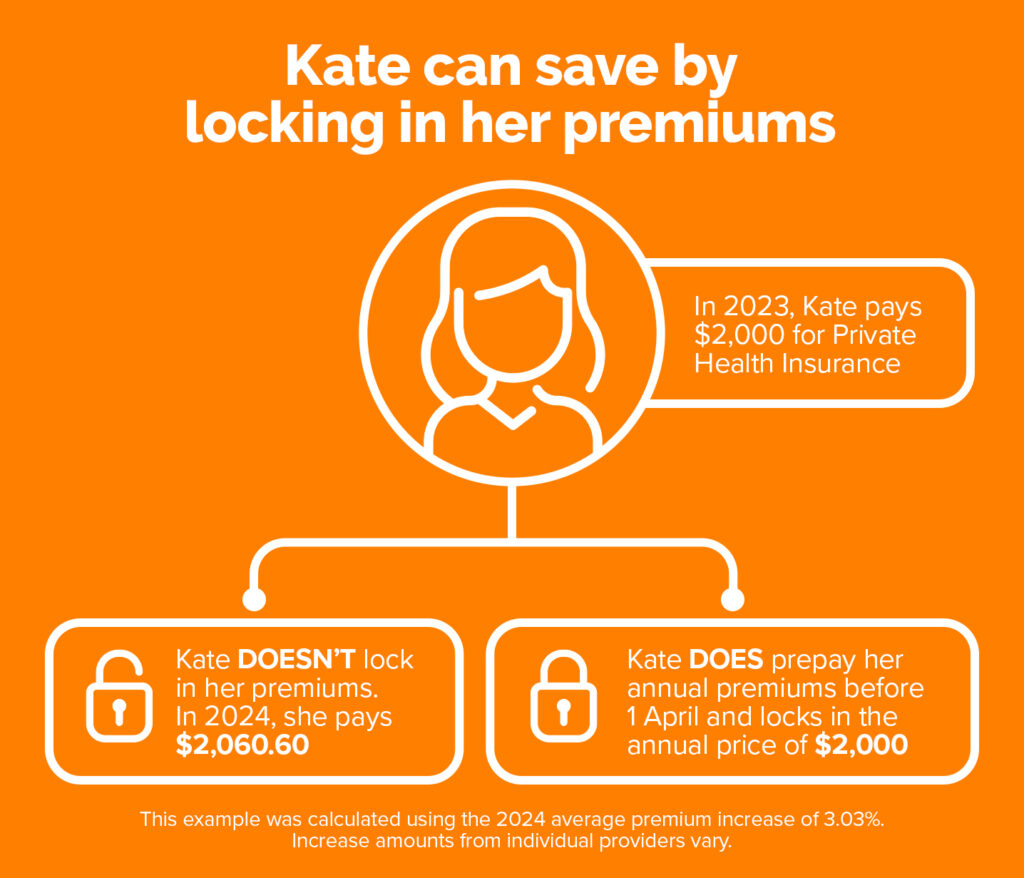

Paying in advance is like doing a slick sidestep – you postpone dealing with those sneaky premium hikes for a whole year. It means snagging a built-in discount of roughly 4% every year, because that’s around how much Health Insurance premiums usually increase annually. For 2024, the average increase of 3.03% will take effect on 1 April, and the next increase will take place on 1 April 2025. But keep in mind, 3.03% is an average only. Some individual policies have risen by more than that and others less.

Source: Department of Health and Aged Care – Private health insurance premiums rise less than wages, pensions and inflation

Are there any other ways I can save on my premium?

- Choose a higher excess: Your premium is the regular fee you pay for your Health Insurance, whether you pay weekly, annually or at some other frequency. Your excess is what you pay up-front when you access hospital treatment. Often, the higher excess amount you choose, the more it lowers your premiums. You just need to be comfortable that you can afford that excess if and when you need to make a hospital claim.

- Only pay for what you need: Take a look at what you’re currently paying for and whether you’re likely to actually use those services. It can be a bit overwhelming to figure out what your coverage options actually are and how to find an economical plan that meets your specific needs. Luckily, our comparison experts can help with that – you can compare online or give them a call on 1800 784 772.

- Shop around: Different providers can offer similar plans for pretty different prices. There’s also potential to save by splitting your Hospital and Extras Cover between different providers. We can help with that too!

Where can I compare Health Insurance policies?

Dive deeper into the art of locking in your premium with iSelect – your insurance sidekick! Give us a ring at 1800 784 772, and our squad of comparison experts will spill the beans on securing that premium like a pro.

You’ll find a treasure trove of Health Insurance policies waiting for your scrutiny. You can uncover the details, spot the policy that suits you, and lock in that premium with confidence.

.svg)