How To Find Suitable Health Insurance

How To Find Suitable Health Insurance

Compare Health Insurance Policies

Save time and effort by comparing a range of Australia’s health funds with iSelect

Benefits of Private Health Insurance

Considering your individual needs

Understanding your life stage

Buying Health Insurance: a timeline

Things to consider when choosing a policy

Am I eligible for a government rebate?

Let’s consider the main life stages in Private Health Insurance

Time to review

Hospital Cover can give you the freedom to choose the hospital where you’d like to receive your treatment, as well as choosing the doctor or specialist who will take care of you throughout the process.1Privatehealth.gov.au – Private health insurance In the private system you may also have reduced waiting times.

However, there can be out-of-pocket costs if your doctor choses to charge above the Medicare Benefits Schedule (MBS) when admitted privately to hospital,2Privatehealth.gov.au – Out of pocket costs but without Hospital Cover, you run the risk of having to pay further costs in the event you need to use the private hospital system.

When choosing Health Insurance, your choices should reflect your budget, any specific health needs, and your general lifestyle.

Benefits of Private Health Insurance

If you’re looking for extra coverage beyond what is provided by the public healthcare system, then you’ll be pleased to know there are many benefits to finding a Health Insurance policy that suits you.

- Quicker access to and reduced wait times for some medical services:3Australian Government | Department of Health & Aged Care – About Private Health Insurance If you find that you regularly need access to specialist medical services and care such as diagnostic procedures and treatments, then Private Health Insurance could be a great way to fast track access to these services. It could also help reduce waiting times for elective surgery procedures such as hip replacements and cataract surgery.

- More hospitals, doctors, and specialists to choose from:4As above. Being able to choose the hospital and doctor you want for your medical care and treatment can give you greater control and peace of mind when it comes to your health.

- Reduced medical costs: Private Hospital Cover can help pay some or all (depending on your policy) of the costs related to inpatient hospital treatments, while Extras Cover can help with the cost of health services not covered by Medicare including dental and physio.

- Pay less tax: Depending on your income, having private hospital cover could reduce the amount of Medicare Levy Surcharge you need to pay come tax time.5As above. If you earn over $90,000 as a single (or $93,000 come 1 July 2023) and don’t have hospital cover, then you’ll have to pay at least 1% extra due to the Medicare Levy Surcharge (MLS).6Australian Taxation Office – Medicare Levy surcharge income, thresholds and rates

- Access to alternative therapies: If you’re interested in or need access to services such as acupuncture, chiropractic care, or dietetics, then Private Extras Cover could help cover the costs of these type of alternative therapies.

- Private Health Insurance Rebate: The Australian Government contributes towards the costs of Private Health Insurance premiums, so you could be entitled to get some money back depending on your eligibility and income.7Australian Taxation Office – Private Health Insurance Rebate

Considering your individual needs

Everyone is different, which can make choosing appropriate coverage overwhelming. If you’re wondering how to pick suitable Health Insurance, you can start by looking closely at your individual health needs.

Whether you’re a couple planning a pregnancy, a student who’s active and healthy, or you’re getting older and in need of regular medical attention, you need to consider that budget, age, lifestyle, and relationship status can all play a part in the decision-making process.

They’re all important factors when it comes to thinking about the different types of Private Health Insurance including Hospital Cover, Extras Cover and ambulance cover.

Understanding your life stage

For Australians keen to take a proactive approach to their healthcare, Private Health Insurance offers more flexibility and security, which in turn can allow you to live a fuller life.

Let’s say you’re a keen runner and you’ve just signed up for your first marathon. While a well-considered training plan is key, pounding the pavement week after week can take a toll on your body.

It’s no surprise then that the option of taking out Extras cover, which can include physiotherapy and podiatry, could help you cross the finish line without injuries.

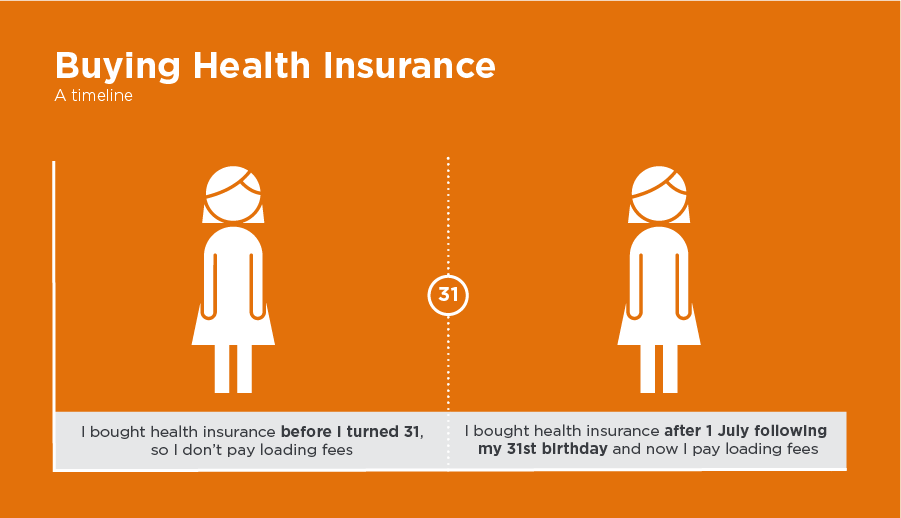

Buying Health Insurance: a timeline

Please note that the graphic below, and the use of the “age 31” is only in relation to Lifetime Health Cover loading (LHC).

Choosing Health Insurance and purchasing a policy before you turn 31 will ensure you won’t have to pay an extra loading if you decide to take out private Hospital Cover later on in life.

If you wait until later in life to take out Hospital Cover (any time following the July 1 after your 31st birthday), you will have to pay a 2% premium loading that increases annually by 2% for every year you don’t have private Hospital cover, which is capped at 70%.8Commonwealth Ombudsman of Private Health Insurance – Lifetime Health Cover

Known as Lifetime Health Cover (LHC) loading, it is added to your premium if you purchase Private Hospital cover for the first time following the July 1st after your 31st birthday, and is removed once you’ve had hospital cover for 10 continuous years. You won’t need to pay it again as long as you continue to keep your private health Hospital cover.

Things to consider when choosing a policy

Think about your health needs now and into the future.

For example, if you want to be covered for obstetrics (pregnancy and birth-related services) in a private hospital and with a private obstetrician, you need to take out or upgrade your cover to include pregnancy before you even start trying for a baby! This is because pregnancy and birth-related services generally have a 12 month waiting period before you can claim.9Australian Government Department of Health and Aged Care – Waiting periods and exemptions

Everyone’s situation is different, so being able to choose a suitable level of Private Health Insurance to fit your lifestyle and budget is key.

Here are some questions to consider when comparing policies:

- Which excess fee is suitable for you?10Commonwealth Ombudsman of Private Health Insurance – Managing your policy, Excess Will opting for a higher excess help reduce your premiums?

- Will you have the right level of cover for the treatments you need?

- Do you want to avoid Lifetime Health Cover (LHC) loading? 11https://www.ato.gov.au/Individuals/Medicare-and-private-health-insurance/Private-health-insurance-rebate/Lifetime-health-cover/

- Does the provider offer any freebies or benefits? (E.g.: free introductory periods, rewards or discounts)

Am I eligible for a government rebate?

Based on your income, you may be eligible to receive a rebate from the Australian Government to help make private hospital cover more affordable.

From 1 July 2023, if you’re on a taxable income of under $144,000 as a single, or $2888,000 as a family, then you could be eligible for a government rebate on Hospital Cover.12Privatehealth.gov.au – Australian Government Private Health Insurance Rebate

Let’s consider the main life stages in Private Health Insurance

Please note that the names and people mentioned below are fictional characters.

I’m young and single

Sarah (25) is an advertising creative. She purchased her own cover when she turned 25 as she was no longer covered by her parent’s Health Insurance once she stopped studying full time.

She spends her spare time trail walking and trekking with her friends. She’s always been physically active but knows she needs to be careful during some of the more dangerous trips.

After reviewing Health Insurance for singles, Sarah has taken out basic level Hospital Cover to help her afford some of the potential out-of-pocket costs if an unfortunate accident occurs and she wants the option to be treated privately. Her policy also includes ambulance cover, which could help her in case she ever gets injured on a difficult hike and needs to be flown to a hospital.

Sarah’s policy requires an excess fee of $500. Since she has taken out Hospital cover before turning 31, she won’t need to pay LHC loading on top of her premiums.

While Sarah is active and also likes to keep fit at the gym, she saves money on her membership fee thanks to her provider’s 15% discount on gym memberships.13AHM – Perks, Goodlife

We’re a couple

Ready to take the next step in their relationship, Lisa (29) and Pete (31) recently purchased an inner-city two-bedroom apartment. They both work full-time, and enjoy evenings at home or dining with friends.

While they share similar interests and needs, Lisa and Pete are also keen to grow their family.

They’ve agreed to take out cover as part of a couples Health Insurance policy which covers them for obstetrics, so they can choose their obstetrician and get a private room if available, as well as Extras to help with things like physio throughout the pregnancy.

Lisa and Pete’s policy requires an excess fee of $750. They’re also exempt from LHC loading, as they took out their policy before they both turned 31.

I have a family

Looking after three kids under 15 can be a handful at the best of times. If Paul (49) and Jackie (46) aren’t driving their youngest daughter to her weekly gymnastics classes, they’re accompanying their son to the optometrist, or paying for braces for their eldest.

Thankfully, their Family Cover helps with some of the costs for the orthodontics and also offers free preventative dental for kids at participating providers.

Paul and Jackie’s requires an excess fee of $750, but they don’t need to pay extra fees for having more than one child. However, since they were both older than 31 when they both took out their policy, they are required to pay for LHC loading of 2% per year on top of their premiums.

Their provider also offers a 25% discount with their local optometrist, which comes in handy for their son’s prescription glasses, which typically need to be updated every 1 to 2 years.

Things sure are busy in their household, but with Combined Cover, Paul and Jackie ensure their family have access to the treatments they need.

I’m getting older

After their kids moved out, Liz (74) and Trevor (77) relocated to a small terrace house where they didn’t have to worry about stairs.

These days, Trevor’s arthritis is causing him a bit of pain, and since Liz had her hip replacement, they’ve found it more difficult to manage their own medical care.

Liz and Trevor are required to pay an excess fee of $500. They took out private Health Insurance later in life, and were required to pay for LHC loading on top of their premiums for 10 years. Since LHC loading is capped at 10 continuous years,14Commonwealth Ombudsman of Private Health Insurance – Lifetime Health Cover they’re no longer required to pay for it on top of their premiums, as long as they continue to hold their Hospital Cover.

Thanks to their couples Combined Cover with included ambulance cover, the pair have access to medical services whenever they need it rather than waiting in the public system.

Time to review

Choosing Health Insurance doesn’t have to be hard. Discuss your specific needs with iSelect’s friendly consultants and they’ll try to help you find a policy to suit your needs. Just call 1800 784 772 today.

Alternatively, you can search online with iSelect to compare your profile against policies from our participating health funds.

Compare health insurance policies the easy way

Save time and effort by comparing a range of Australia’s health funds with iSelect

WE’RE HERE TO HELP

Need help with health insurance?

We can help you find a suitbable product for your needs

Health Insurance & Tax

Tax Implications on Health Insurance

About the Medicare Levy Surcharge

About the Life Time Health Cover Loading

Government Rebate & Means Testing

.svg)