TUH Health Fund

TUH Health Fund

Compare Health Insurance Policies

Save time and effort by comparing a range of Australia’s health funds with iSelect

What is TUH?

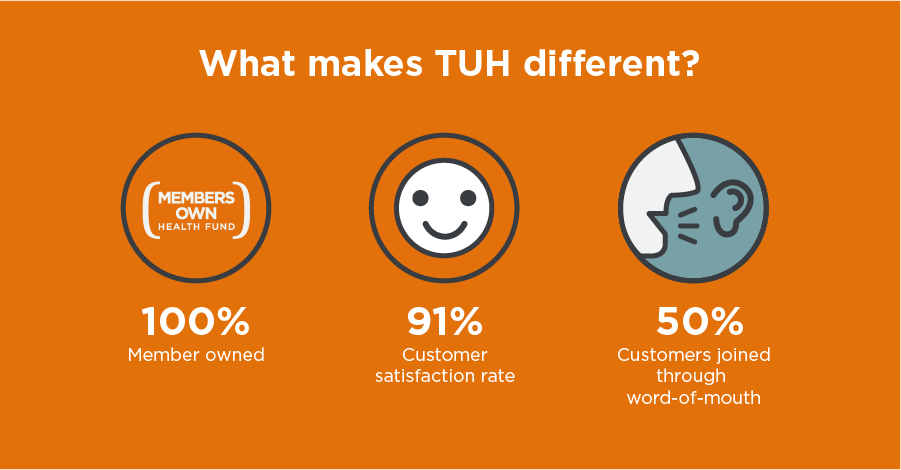

What makes TUH different?

Who can join TUH?

What type of hospital cover does TUH offer?

What type of Extras cover does TUH offer?

Does TUH offer member benefits?

Does TUH cover pre-existing conditions?

Does TUH cover telehealth services?

How do you make a claim with TUH?

How do you make payments for TUH?

How do you become a TUH member?

What is TUH?

Over the last five decades, TUH (Teachers’ Union Health Fund) has grown from a fund that was launched in Queensland to provide quality health cover for teachers to a provider that has opened its doors to all Australian union members and their families.

TUH members include nurses, firefighters, teachers and government employees – just to name a few.

What makes TUH different?

A major benefit of joining TUH is that it’s a not-for-profit fund that is 100% member-owned. The majority of premiums you pay go straight back to member benefits instead of profit to shareholders.1TUH – Why TUH?

They have been awarded Private Health Insurer of the Year in the Roy Morgan Customer Satisfaction Awards (2022),2TUH – TUH awarded Private Health Insurance of the Year in the Roy Morgan Customer Satisfaction Awards which is a testament of TUH’s exceptional services and customer-centric approach.

Another reason to join TUH is their high customer satisfaction rating. According to an IPSOS Public Affairs survey in 2021, TUH members reported a satisfaction rating of 91%, compared with an industry average of 69%.3TUH – TUH Health Fund Gets Top Marks In Major Customer Survey

TUH is also known for the user-friendly service through an app for members to easily submit, track, and manage their claims from their phone.4TUH – Mobile App

They also offer Wellbeing Benefits, which provides members with up to 30% off a range of brands and services.5TUH – Wellbeing Benefits

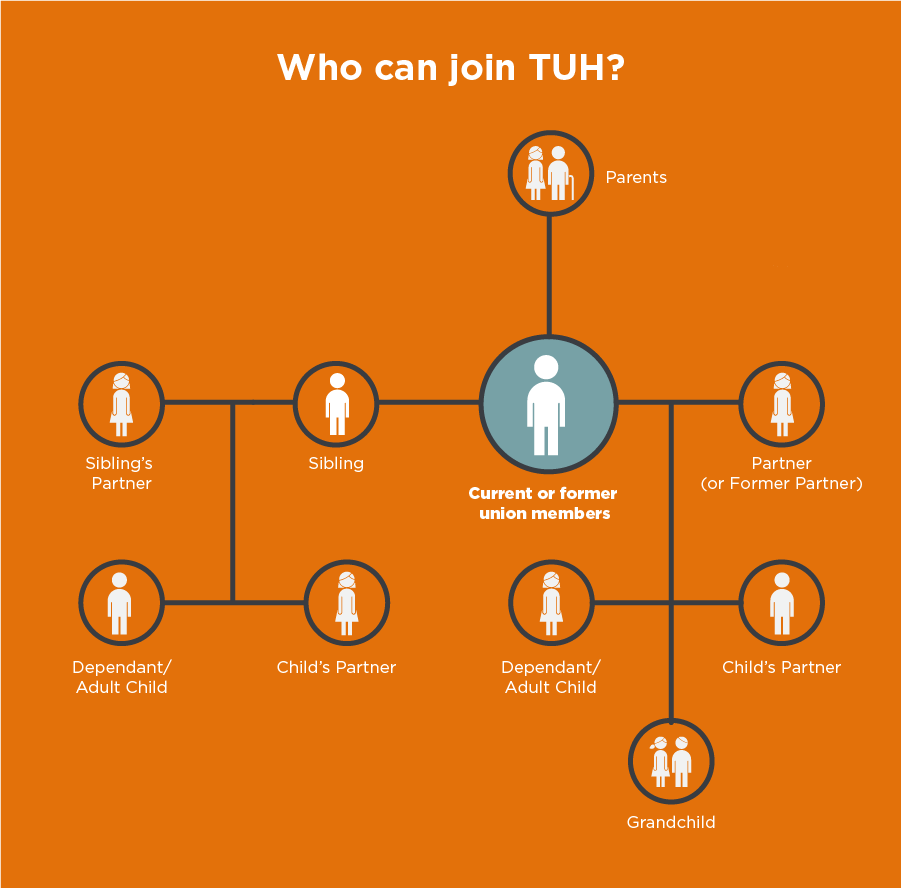

Who can join TUH?

TUH is not just for teachers. Over the years they expanded to welcome members of any Australian Union and their immediate family members.6TUH –Who Can Join?

TUH defines a family member as a parent, partner, former partner, dependent child, adult child, grandchild, and siblings.

If you meet the criteria to join TUH, you can get cover whether you’re single, a couple, a family or a single parent family.

What type of hospital cover does TUH offer?

If you join TUH, you can choose between separate hospital cover – or a combination of hospital and extras cover under one policy (note: TUH hospital cover is currently only available when purchasing combined with extras cover through iSelect).

Hospital insurance covers a portion of hospital fees, such as medical fees, hospital accommodation, intensive care and hospital medication. TUH provide a range of hospital cover options that are in line with the Federal Government’s tiered health insurance system. Available through iSelect, these include:

- Basic+ Hospital: This includes services such as dental surgery, joint reconstructions, hernia and appendix, and tonsils, adenoids and grommets. It offers either a $500 or $750 excess fee.7TUH – Basic+ Hospital

- Bronze+ Hospital: This cover provides treatment in a private hospital for medically necessary treatment for a wide range of services (restrictions and exclusions apply). It has the option of either a $500 or $750 excess fee.8TUH – Bronze+ Hospital

- Silver+ No Pregnancy: This cover provides a wide range of hospital treatments, excluding pregnancy and birth, assisted reproductive services and weight loss surgery. It has the option of either a $400 or $750 excess fee.9TUH – Silver+ No Pregnancy Hospital

- Bronze+ Young Choice: This cover provides private hospital treatment for a wide range of services with some exclusions and extras cover. It includes cover for medically necessary inpatient treatment, accommodation, theatre fees, intensive care and medication up to the Medicare Benefit Schedule Fee for included hospital services.10TUH – Bronze + Young Choice

Check out the TUH website for a comprehensive list of their hospital policies.

What type of Extras cover does TUH offer?

When it comes to Extras, you can choose a separate Extras policy with TUH, or you can choose a combination hospital and extras policy.

Extras insurance covers general, non-hospital treatment like TUH dental, physiotherapy, optical and chiropractic care. TUH’s Extras cover includes the following:

- Basic Extras: Affordable cover for key services like general dental, optical and selected therapies such as chiropractic, physiotherapy, massage therapy and osteopathy.11TUH – Basic Extras

- Mid Range Extras: A selected range of extras including general and major dental, orthodontics, optical and other therapies. Provides up to 80% on health screenings and health management programs.12TUH - Mid Range Extras

- Healthy Options Extras: Provides general and major dental, optical, physiotherapy, and other therapies, with a 60% benefit on included extras up to your annual limit.13TUH - Healthy Options Extras

- Family Extras: Offers optical, speech therapy, orthotics, massage therapy, and limitless preventative dental for families.14TUH - Family Extras

- Comprehensive Extras: A wide range of extras, including dental, orthodontics, physiotherapy, massage, podiatry, health appliances and more, with annual limits increasing over years of membership.15TUH - Comprehensive Extras

Does TUH offer member benefits?

TUH offers a range of benefits for its members, including a wide network of preferred providers, a range of cover inclusions within their policies, and discounts on selected brands.

Combined hospital and extras products (except products combined with Basic Extras) also provide an Active Health Bonus, which can help you reduce out of pocket expenses on selected extras.16TUH – Active Health Bonus

Does TUH cover pre-existing conditions?

Yes, members are covered for pre-existing conditions when:17TUH – Pre-existing Conditions

- They are new to Health Insurance (with a 12-month wait for hospital benefits)

- They are transferring or upgrading to a higher level of hospital cover (with a 12-month wait for the higher hospital benefits), which is required by all health insurances funds

- They have already served waiting periods on a previous hospital cover policy.18TUH – Waiting Periods

Does TUH cover telehealth services?

Yes, TUH offers telehealth access for the following services:

- Physiotherapy

- Exercise physiology

- Psychology

- Dietetics

- Occupational therapy

- Speech therapy

- Antenatal and postnatal midwife services

- Lactation consultations

How do you make a claim with TUH?

When making a claim with TUH, you can choose the method that suits you best. You can swipe your TUH member card on the spot – if your health provider offers the Health Industry Claims and Payments Service (HICAPS) technology at their clinic.

Or, you can claim your services online through the TUH member portal or via the TUH app.

You can also email or post your TUH claim form for payment.

How do you make payments for TUH?

You can pay through direct debit from your bank account or via credit card, provided that it’s either Mastercard or Visa. You can make your payments monthly, or pay for six months upfront.

How do you become a TUH member?

Considering getting cover for you and your family with TUH? At iSelect, we’ve made it easy for you. Have your Medicare card ready to go and simply jump online – or call 1800 784 772 and one of our consultants can help you out.

Compare your health insurance from a range of plans and providers with iSelect today*.

Compare health insurance policies the easy way

Save time and effort by comparing a range of Australia’s health funds with iSelect

WE’RE HERE TO HELP

Need help with health insurance?

We can help you find a suitbable product for your needs

Health Insurance & Tax

Tax Implications on Health Insurance

About the Medicare Levy Surcharge

About the Life Time Health Cover Loading

Government Rebate & Means Testing

.svg)