Is Life Insurance Tax Deductible?

Is Life Insurance Tax Deductible?

*iSelect’s partnered with Lifebroker to help you compare a range of Life Insurance policies. Not all policies are available at all times or in all areas. Any advice provided on this website is general in nature and does not consider your situation or needs. Please consider if any advice is appropriate for you before acting on it. Learn more.

Easily compare life insurance quotes

Save time and effort by comparing life insurance with iSelect’s trusted partner Lifebroker*

The term ‘life insurance’ refers to four types of cover: life, trauma, total and permanent disability (TPD) and income protection. Each cover has a different purpose. You’re likely to have some cover through your superannuation fund, but it may not be tailored for you.

You can also purchase insurance outside of your super from insurance companies, brokers or financial advisers.

The different types of life insurance

When people speak about life insurance, they’re referring to the following four types of cover:

• Life insurance – also referred to as ‘life cover’, ‘death cover’ or ‘term life insurance.’ If you pass away, your life insurance policy may pay out a pre-agreed amount of money in a lump sum to you or your nominated beneficiaries.

• Trauma cover – also referred to as ‘critical illness cover’ or ‘recovery insurance.’ This insurance provides cover for specified illnesses like cancer, strokes and heart attacks. In a worst-case scenario, you could be paid a lump sum to help with your medical expenses, ongoing recovery and rehabilitation costs.

• Total & permanent disability (TPD) – if you’re permanently unable to work because of a serious injury or illness, you could be paid a lump sum to assist with rehabilitation and living costs.

• Income protection – also known as ‘salary continuance cover’, this insurance is usually paid in regular monthly instalments if you’re unable to work due to injury or illness. You could receive up to 70% of your work income for a specified period.

If the unthinkable should happen to you, these four types of life insurance may help you continue meeting important financial obligations.

They can also relieve the intense financial pressure your family or beneficiaries will feel if you’ve passed away.

How are life insurance premiums calculated?

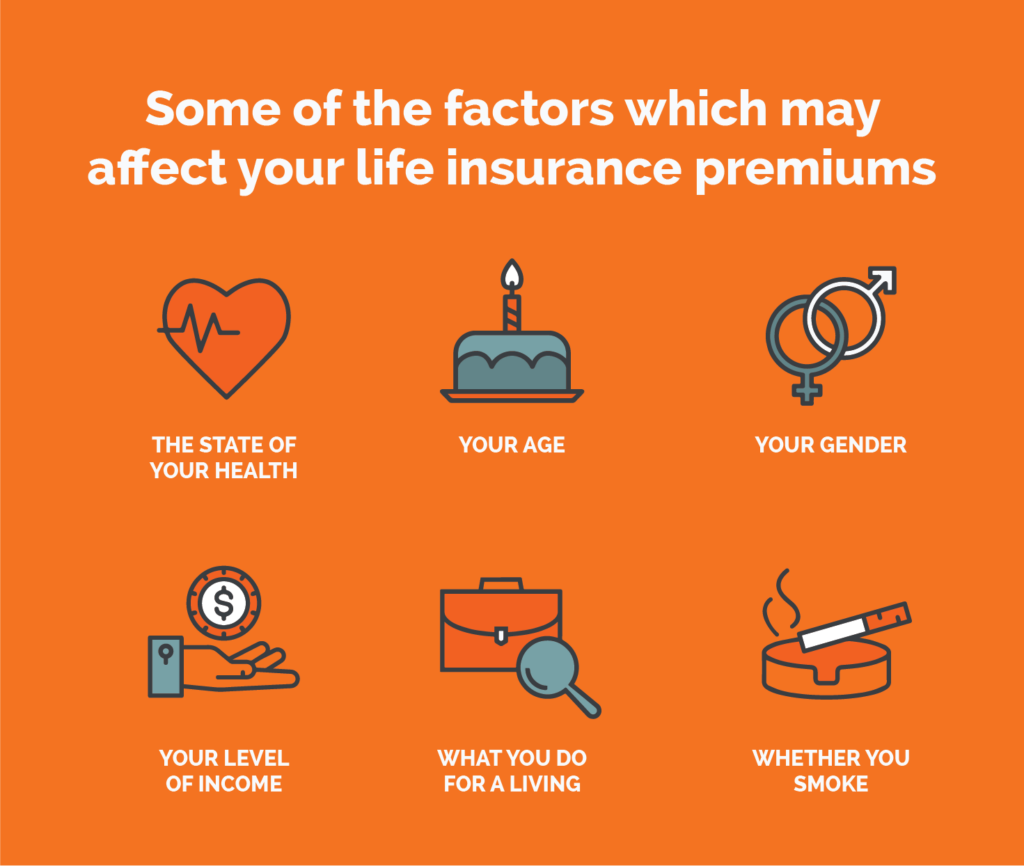

The premiums for all four types of life insurance are calculated based on various factors.1https://www.moneysmart.gov.au/tools-and-resources/publications/factsheet-personal-insurance These can include:

• Your age

• Your gender

• The state of your health

• Whether you smoke

• What you do for a living

• Your level of income

To finalise the cost of your policies, insurance companies may ask for health checks to be made as well as other financial information. This can include proof of income.

Is life insurance tax deductible when obtained through superannuation?*

Through your superannuation fund, you may have some life cover, TPD and income protection.

Each of these types of cover are paid for through deductions from your super account balance.2https://www.moneysmart.gov.au/superannuation-and-retirement/how-super-works/insurance-through-super The Australian Taxation Office (ATO) advises that the premiums on insurance policies taken through super accounts aren’t personally tax deductible.3https://www.ato.gov.au/Individuals/Income-and-deductions/Deductions-you-can-claim/Other-deductions/Income-protection-insurance/ Super funds don’t provide trauma insurance.

Is life insurance tax deductible if I get it outside of superannuation?*

The ATO advises that under any circumstance, a premium or any part of a premium isn’t tax deductible if the policy compensates you for physical injuries3.

This means that if you’ve bought life, TPD or trauma cover policies outside of super they’re not tax deductible. You can, however, claim tax deductions on the premiums you pay for insurance against the loss of your income.

So if you’re purchasing higher levels of income protection outside of your super fund, you can personally tax deduct this. The amount you’ll be able to deduct will be based on how much you earn and the tax bracket you fall under.

Ready to find a suitable Life Insurance policy with Lifebroker?

At the end of the day, the only form of life insurance that’s personally tax deductible through an individual policy is income protection. Click here to compare policies with Lifebroker today.

Easily compare life insurance quotes

Save time and effort by comparing life insurance from a range of policies and providers with iSelect’s trusted partner Lifebroker*

.svg)