Commercial Property Insurance

Commercial Property Insurance

*iSelect’s partnered with BizCover Pty Ltd to compare a range of small business insurers and policies in the market. Not all policies are available at all times or in all areas. Our advice on this website is general in nature and does not consider your situation or needs. Consider if any advice is appropriate for you before acting on it. Learn more.

Compare business insurance the easy way

We’ve partnered with BizCover to help you compare business insurance policies.*

Who can benefit from commercial property insurance?

What does commercial property insurance protect against?

How does commercial property insurance protect you?

Ready to find a commercial property insurance & building insurance policy?

Keep reading to learn how a commercial property insurance policy could help you.

Who can benefit from commercial property insurance?

Whether your business is business-to-business, business-to-consumer, retail or online only, protecting your place of business is something to consider. More than just a place where you work, the condition and nature of your property can contribute greatly to how your business is perceived. Losing your property can be costly not just to your bottom line, but to your brand’s strength.

As such, any business that owns, mortgages, or rents property may benefit from commercial property insurance.

These costs can multiply when the business affected is involved in manufacturing, warehousing or any other industrial field – organisations in this sector can really struggle to get back on their feet after the loss of property, plant, equipment and stock.

What does commercial property insurance protect against?

A typical commercial property insurance policy usually provides coverage* for damage sustained to the structure itself – including fixtures and fittings, services and utilities provided to the building, structural improvements made to the building, and shipping containers and portable buildings permanently situated on the property – and contents thereof, subject to the limits and exclusions of the particular policy.

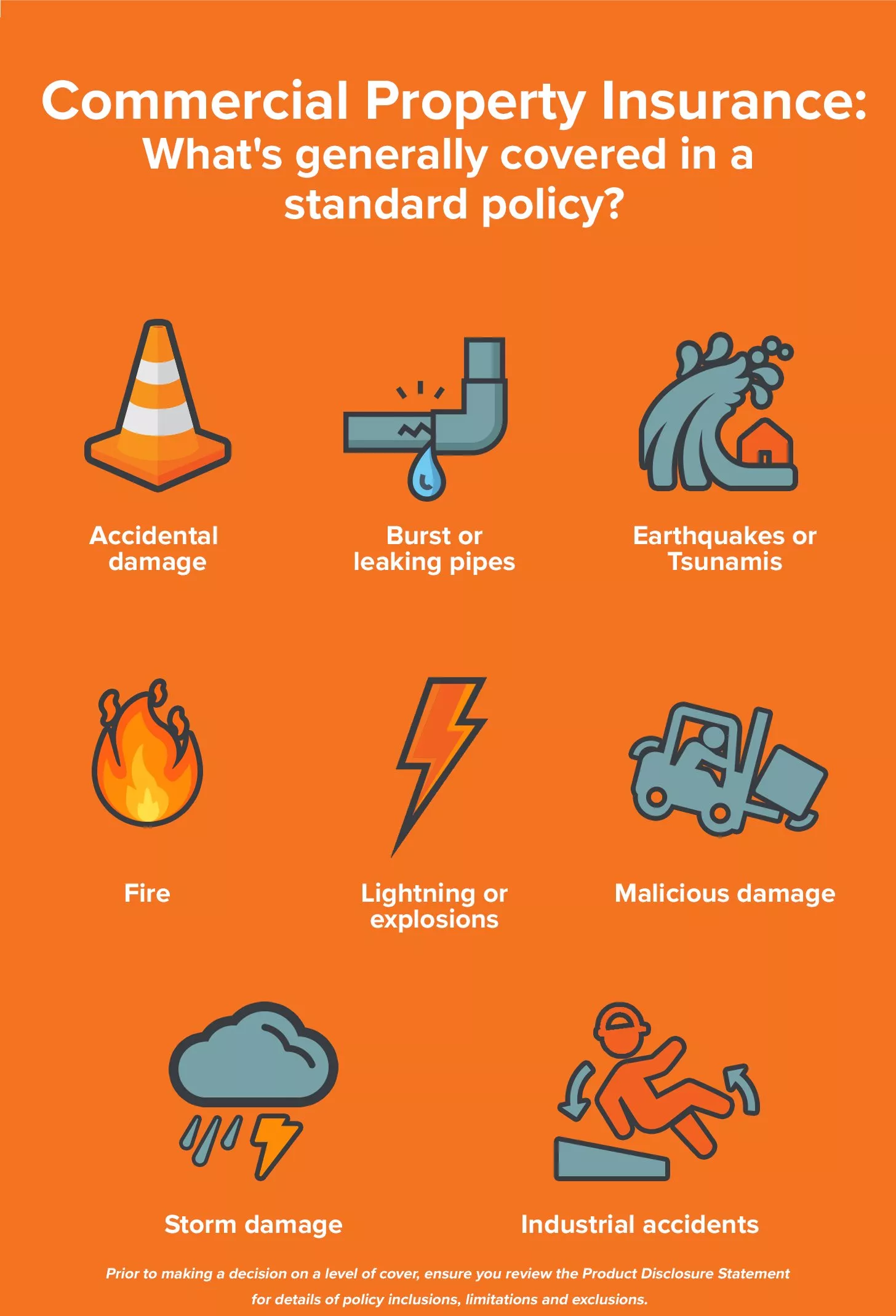

Commercial property insurance can provide broad coverage for damage resulting from a range of events, but as with every insurance product, the specific terms and conditions of your policy will determine your inclusions, exclusions and policy limits. Depending on the insurer, these events can include:1https://www.bizcover.com.au/wp-content/uploads/2017/03/AIG-Business-Pack-Policy-Wording-09.00654.5.pdf

- Accidental damage

- Burst or leaking pipes

- Earthquake or tsunami

- Fire

- Impact by a vehicle or falling object

- Lightning or explosion

- Malicious damage

- Storm damage

- Industrial accidents such as escape of molten material

How does commercial property insurance protect you?

Coverage under a commercial property insurance policy differs from some other products in that the insurer has several methods of paying out your policy, depending on the nature of the asset and the extent and type of damage suffered. What constitutes coverage can take a number of forms, which may include:2As above

- Paying the cost of rebuilding, replacing, or repairing the building or contents

- Replacing contents and stock with similar items

- Rebuild the building at the premises or at another site

In most cases, insurers will reserve the right to choose from these options for each item damaged.

Additionally, coverage for certain high value items may be capped at a certain amount,3https://www.bizcover.com.au/wp-content/uploads/2019/06/QM485-1118-Business-pack-insurance-poicy-web.pdf especially for items deemed works of art, antiques or curios. Because of this, it is important that policy-holders understand not just how much coverage they’re being provided as a whole, but how this coverage is divided between their assets and how it will be paid out*.

Ready to find a commercial property insurance & building insurance policy?

If you’re looking to protect your business from accidents, vandalism, and natural disasters, you may consider purchasing commercial property insurance for your building and contents.

At iSelect we’ve partnered with BizCover to help you compare business insurance products from a range of providers. Get started today!

*Please note that all insurance is subject to the terms and conditions set out in the policy wording or Product Disclosure Statement. The information set out above is general only and should not be relied upon as advice.

.svg)