Travel Insurance For Brazil

Travel Insurance For Brazil

*iSelect does not compare all travel insurers or policies in the market and not all policies or special offers are available at all times or in all areas. We currently only provide a comparison service online. Not all policies available from our providers are compared by iSelect and due to commercial arrangements and customer circumstances, not all policies compared by iSelect are available to all customers. Learn more.

Easily compare Travel Insurance

Save time and effort by comparing a range of travel insurance policies with iSelect*

What to do in Brazil – and how to stay safe doing it

Potential problems in Brazil

What your travel insurance could cover

What’s excluded?

This should come as no surprise, since Brazil is such a big country with almost every climate you can imagine. Plus, there’s the annual travel drawcard of Carnaval!

What to do in Brazil – and how to stay safe doing it

Brazil spans nearly the whole length of South America, from the Amazon Basin in the north to Iguaza Falls in the south, providing tourists with the opportunity to experience a range of landscapes and climates.

- Beaches: Hanging out at Copacabana or Ipanema is an iconic Brazilian beach experience. As well as dangerous riptides, some beaches are hotbeds for petty crime, with tourists frequently targeted. Pay close attention to your belongings, take only what you need, and having travel insurance could provide cover should you become a victim.

- Exploring the Amazon: With spectacular but remote scenery, trekking in the Amazon rainforests can be an impossible to forget adventure. But there’s a significant risk of becoming lost or injured, so be sure to travel with an experienced guide. Having suitable travel insurance could help cover any medical and rescue costs.

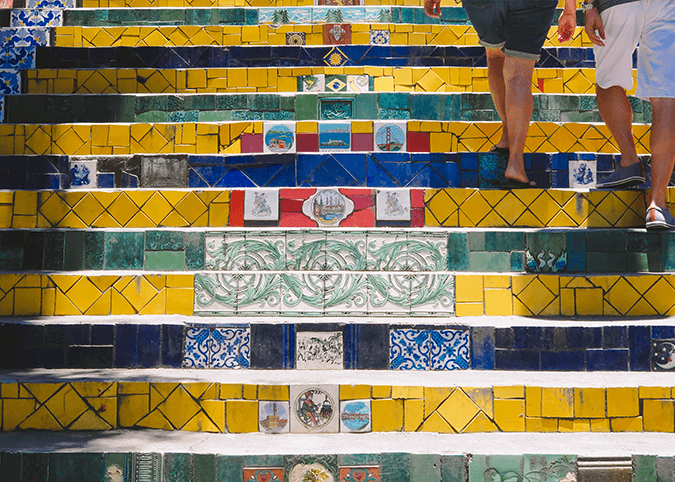

- Party at Carnaval: The colour, sounds, and energy of Carnaval, held each year in Rio de Janeiro in February or March (it ends 40 days before Easter), is on many travellers’ bucket list. But sadly, tourists are regularly victims of crime at the event, so having suitable travel insurance could be beneficial if you’re travelling to these areas.

- See Christ the Redeemer: It’s one of the world’s most recognised icons, gazing out over the city of Rio de Janeiro. The views are spectacular and it’s incredible to think about how this statue was made. However, yet again, crime targeting tourists is rife, so be prepared for the worst and only take essentials. Travel insurance could assist in replacing any lost or stolen possessions.

Potential problems in Brazil

Some parts of Brazil aren’t safe for tourists1https://smartraveller.gov.au/countries/americas/south/pages/brazil.aspx and it may come as a shock to Aussies to find that there are some serious no-go areas, such as the favelas. If you’re targeted by criminals, it’s recommended to hand over your belongings and avoid escalating the situation. As well as high crime rates in some parts, there’s also the risk of mosquito-borne diseases like dengue fever, malaria, yellow fever, as well as the Zika virus.2https://smartraveller.gov.au/countries/americas/south/pages/brazil.aspx For diseases like yellow fever, you can get a vaccination before you leave.

What your travel insurance could cover

Your medical costs

Australia does not have a reciprocal health care agreement with Brazil, so a policy that covers medical costs can be beneficial. If you’re injured or get ill, you could be covered for your medical treatment, as well as for medical repatriation and in-hospital cash. While the hospitals in Brazil’s big cities are fine, you may need to prove you can pay, or that you’re insured before you’re admitted.

Your luggage

If you lose your luggage, or if it’s stolen or damaged, then you’ll be reimbursed. Comprehensive insurance can also cover cash and travel documents. Make sure you never leave your luggage unattended, though, or your insurer could refuse to reimburse you.

Your rental car

Brazil’s roads can be busy, and let’s just say not everyone pays attention to traffic lights! Driving in Brazil is dangerous, so consider if a rental car is the best way for you to get around. The Australian government recommends not driving at all in Rio de Janeiro1. Should you decide to drive in Brazil, make sure you have an International Driving Permit, and having a comprehensive travel insurance policy could provide cover should the unexpected happen.

That said, you’ll likely still have to pay the rental company’s excess.

Travel disruption and cancellations

Life happens and sometimes plans need to change. If your travel plans are disrupted while you’re in Brazil, or before you leave, and you need to reschedule or cancel an event or trip, you could be reimbursed for any additional costs you incur.

What’s excluded?

If you fail to declare any pre-existing health conditions and you need treatment while in Brazil, you won’t be insured for it. Also, if you ignore travel advice from the Australian Government and go to an area that’s deemed unsafe and find yourself in trouble, you may find you won’t be covered.

Reckless behaviour, like riding a motorcycle without a helmet, isn’t usually covered, as are any alcohol or drug-related incidents.

.svg)