Compare Car Insurance Policies

Save time and effort by comparing a range of car insurance quotes with iSelect

.svg)

13 19 20

13 19 20

Save time and effort by comparing a range of car insurance quotes with iSelect

Most new cars are purchased through a factory-backed importer that looks after regulatory compliance, warranty and after-sales support.

But some people choose to import a car privately or use an importation service to get access to models that were never offered through the official dealerships.

It’s important you know if the car you’re looking at has been imported privately. This can usually be determined by a check via the Personal Properties Securities Register (PPSR), which costs just two dollars.

Before you take out Car Insurance on your import, there’s some admin and paperwork you’ll need to organise.

All vehicles need a vehicle import approval from ROVER (Road Vehicle Regulator)prior to entering Australia.

Once you receive approval from ROVER, you can work out the type of import you’re doing by visiting the Department of Infrastructure, Regional Development, Communication and The Arts. Here you will find details of the ways vehicles are imported into the country.

Did You Know?

If you’re importing the car without the assistance of a Registered Automotive Workshop, then you’ll also need to arrange shipping, get clearance from customs, meet Australian quarantine requirements, and register the vehicle.

The Road Vehicle Standards Act 2018 (RVSA) has officially replaced the Motor Vehicle Standards Act 1989 (MVSA).

This new framework is one of the biggest legislative overhauls of road vehicle regulation in over 30 years, and reflects the standards required for the 21st century across the nation.

The transition began in 2021, and was extended until 30 June 2023. This was enforced to support parts of the industry that have been impacted by the COVID pandemic and global supply chain issues.

A locally purchased car is likely to come with a lower cost of Car Insurance than an imported vehicle. Getting cover for your import can be tricky, as not all providers will cover your vehicle type.

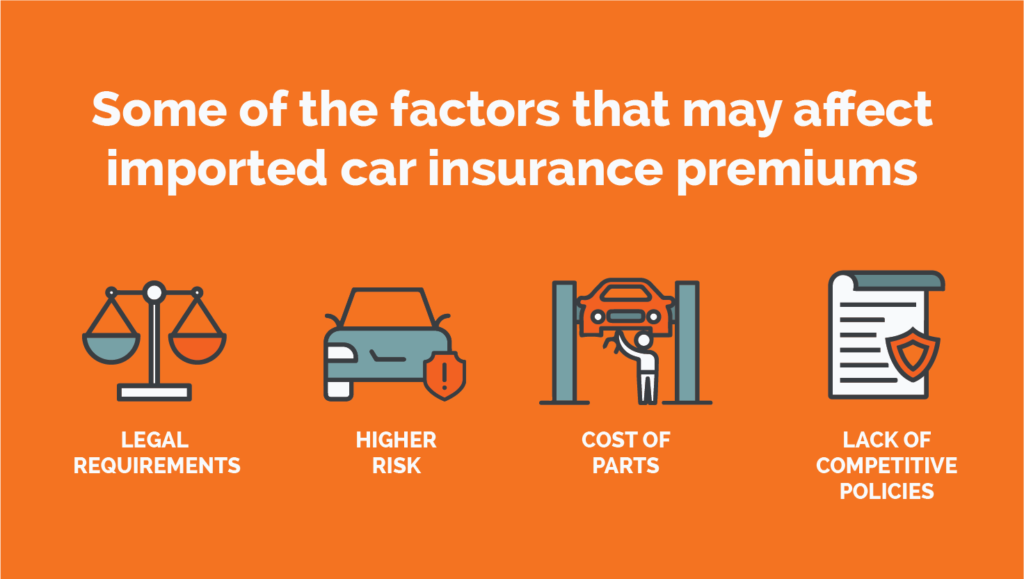

A few of the reasons for imported Car Insurance being higher are due to:

Imported cars are designed to meet the standards of the country they were made for. For this reason, modifications may be needed to meet legal requirements in Australia. Anytime a vehicle has a modification, insurance costs can increase. This is likely because it’s harder for insurers to determine the vehicle’s value.

Historically, imported cars have been modified for performance. Insurers therefore treat them as more likely to be involved in a high-speed accident, so this too can affect the cost of your Car Insurance.

Spare parts and repairs for imported cars are often more expensive and in some instances the parts may not be readily available. These additional costs are considered when calculating your premium.

Not all insurers regularly cover imported vehicles. This means that your car could fall into a default high-performance category purely because they don’t have any other category to place your car into.

Not all car insurers offer policies for imported vehicles. So before your import makes its way to Australia or you buy a used one that was previous imported, make sure to do some research on your Car Insurance options well in advance.

While some of the larger insurers do offer coverage for imports, often choosing a specialist insurer who concentrates on imported or modified cars can be a more cost-effective option. This is because these non-standard insurers often have more categories for specialty types of vehicles.

A smart approach would be to get some Comprehensive Car Insurance quotes from regular providers, then compare them to some quotes from specialist providers.

A specialist provider can distinguish a high-performance vehicle and a vehicle that’s driven by a safe, experienced driver with a passion for cars.

As well as considering the price point for the two, be sure to check the conditions of the policy. Specialist insurers often have a variety of extra benefits that standard providers don’t.

Helpful Tip:

Helpful Tip:If your privately imported car wasn’t cheap then an agreed value policy might be worth considering. They can provide cover for the original price of your car if it gets written-off or needs extensive repairs. Yes, these policies are usually a little more costly, but they can provide much better protection for a car that could be difficult to replace.

You may have more limited insurance options than a domestic car, but there are still ways you can save on your premium for your imported vehicle. Look for discounts or deals which are commonly available by taking out a policy online.

Insurers may look favourably on efforts you make to reduce the chance of your car being stolen.

For example, keeping the car in your garage and equipping it with a car alarm and immobiliser could be a smart move. An approved Defensive Driving course could also be taken into account with some insurers.

Before signing up for a policy, be sure to check all the terms and conditions that could impact a claim. This could include restrictions on the age of drivers, or the number of modifications you’re able to make.

Save time and effort by comparing a range of car insurance quotes with iSelect

iSelect does not compare all car insurers or policies in the market. The availability of policies may change from time to time. Not all policies available from iSelect’s providers are compared by iSelect and due to commercial arrangements, area or availability, not all policies compared by iSelect will be available to all customers. Some policies are available only from iSelect’s call centre or website. A number of our participating general insurance brands are arranged by Auto & General Services Pty Ltd ACN 003 617 909 on behalf of Auto & General Insurance Company Limited 111 586 353, both of which are related entities of iSelect Limited. Our relationship with those companies does not impact the integrity of our comparison service. Click here to view iSelect’s range of providers.

iSelect General Pty Limited ABN 90 131 798 126, AFS Licence Number: 334115. Any advice provided by iSelect is of a general nature and does not take into account your objectives, financial situation or needs. You need to consider the appropriateness of any information or general advice iSelect gives you, having regard to your personal situation, before acting on iSelect’s advice or purchasing any policy. You should consider iSelect’s Financial Services Guide which provides information about our services and your rights as a client of iSelect. iSelect receives commission for each policy sold that is a percentage of the premium or a flat fee. Ask us for more details before we provide you with any services.