Accident-Only Pet Insurance

Accident-Only Pet Insurance

*iSelect’s partnered with Choosi Pty Ltd to compare a range of pet insurers and policies. Not all policies are available at all times or in all areas. Our advice on this website is general in nature and does not consider your situation or needs. Consider if any advice is appropriate for you before acting on it. Learn more.

Easily compare Pet Insurance

We’ve partnered with Choosi to help you compare pet insurance policies.*

What do accident-only policies cover?

So what exactly is an ‘accident’?

Factors to consider when purchasing accident only pet insurance

As the price of vet care has increased over the years1https://www.ava.com.au/news/media-centre/hot-topics-3, more Australians are turning to pet insurance to ensure they’re not overwhelmed by hefty vet bills for their pet.2https://www.parliament.vic.gov.au/images/stories/committees/osisdv/Liveability_Options/Sub_60_Petcare_Information__Advisory_Service_6.05.2011_LiveabilityOptions_OSISDC_Attachment_E.pdfIn this article, you’ll learn about accident-only pet insurance, and whether or not it’s the right type of policy for your pet.

What do accident-only policies cover?

If you’re looking to reduce your pet insurance costs, and are confident your pet is healthy, accident-only insurance could be the answer. But what does it cover?

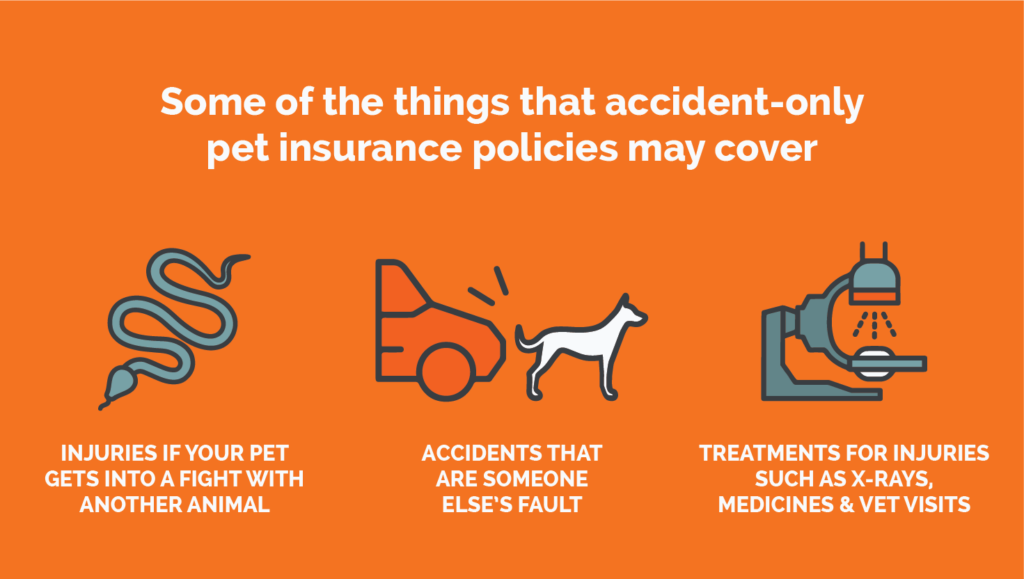

It’s always crucial to check the details of any policy you’re considering. Many accident policies will cover your pet for accidents that are someone else’s fault, such as a car accident, or even allergic reactions to parasites. Accident-only policies will also tend to cover injuries if your pet gets into a fight with another animal, a snake bite, or other cuts and scratches caused by others.

Most policies will cover a good range of treatments for injuries such as x-rays, medicines, visits to vets, and lab tests as needed.

So what exactly is an ‘accident’?

While you may be surprised at some of the incidents and injuries that you can claim for, make sure you’re clear about what isn’t covered.

It’s not just what the policy does and doesn’t cover that you need to be clear about, but also what your policy defines as an ‘accident’. All insurance policies will have a pretty clear definition of an ‘accident’, but the definition will vary by insurer, so make sure you check the details carefully.

For example, a pre-existing condition made worse by an accident may not be covered, or an incident seen as an accident by you, may not be seen in the same way by the insurer. The best way to understand these sorts of conditions is to read the policy’s product disclosure statement, as well as compare policies from multiple insurers before finding the right one for you.

Factors to consider when purchasing accident only pet insurance

When comparing accident-only pet insurance policies, it may be important to keep a few core considerations in mind.

1. How healthy is your pet?

If your cat or dog is in great health, you may not be as concerned about them getting ill. In this instance, an accident-only policy may be more appropriate—and could result in lower premiums too.

2. How much time does your pet spend outdoors?

If you pet spends more time outside, especially if it’s a cat and is allowed to roam the neighbourhood, then it’s more likely to get into an accident. Therefore, having accident-only insurance can help cover the some of the costs if your pet gets into an accident and needs treatment.

3. How old is your pet?

As pets get older, just like humans, they usually require more medical treatment. This can include both medicine, vet visits, and surgical treatment. If your pet is older, and you’re looking for a policy to cover ongoing costs, then accident-only cover may not be sufficient.

4. Does your pet have any existing conditions or injuries?

If your pet has any injuries or conditions before or during the time you purchase your policy, then you likely won’t be covered for any accidents which exacerbate this existing injury. For example, if your pet has a broken leg when you purchase your policy, you won’t be covered for any treatment for this ailment, or subsequent complications that arise from it.

Find a suitable policy with iSelect

Whatever type of policy you go for, there’s a lot to consider. With so many insurers and different policy options out there, the choices can often seem overwhelming.

At iSelect, we’ve simplified the process. By entering some basic details online, you can compare offers from a range of providers to find a policy for your pet. Compare online, or call us today on 13 19 20.

Easily compare Pet Insurance quotes

Select cover for your pet from a range of brands through Choosi.*

*iSelect’s partnered with Choosi Pty Ltd (ABN 15 147 630 886) to help you compare pet insurance policies. iSelect earns a commission from Choosi for every policy sold through the website or contact centre. iSelect and Choosi do not compare all providers or policies in the market.

Any advice provided by iSelect on this website is of a general nature and does not take into account your objectives, financial situation or needs. You need to consider the appropriateness of any information or general advice we give you, having regard to your personal situation, before acting on our advice or purchasing any policy. You should consider iSelect’s Financial Services Guide which provides information about our services and your rights as a client of iSelect. iSelect receives commission for each policy sold by Choosi.

.svg)