Pet Insurance For Seniors In Australia

Pet Insurance For Seniors In Australia

*iSelect’s partnered with Choosi Pty Ltd to compare a range of pet insurers and policies. Not all policies are available at all times or in all areas. Our advice on this website is general in nature and does not consider your situation or needs. Consider if any advice is appropriate for you before acting on it. Learn more.

Easily compare Pet Insurance

We’ve partnered with Choosi to help you compare pet insurance policies.*

What are the costs of pet ownership?

How do I find suitable pet insurance as a senior?

Are there any specific pet insurance policies designed for seniors?

Is pet insurance just another cost for seniors?

What is the cost for pet insurance?

How does the claims process typically work?

How do I choose a policy?

If you’re a senior on a limited or fixed income, it’s all the more important to understand these costs and consider how pet insurance could help.

What are the costs of pet ownership?

As a senior who carefully watches what you spend, its likely you know the costs that are involved in your weekly grocery shop. But did you know that research suggests that on average pet owners are spending $3,200 per dog and $2,100 per cat each year?1https://animalmedicinesaustralia.org.au/wp-content/uploads/2021/08/AMAU005-PATP-Report21_v1.4_WEB.pdf (page 4)

Perhaps you’re thinking about getting a cat or dog. Typically, the costs involved in the first year of buying and caring for a cat or dog can cost anywhere between $3,000 to $6,000.2https://moneysmart.gov.au/getting-a-pet

These costs can also include council registrations, which are typically between $30 to $190 per year.3As above

Plus, you’ll also need to take care of ongoing expenses such as:

- Food

- Vet services (microchipping, vaccinations, de-sexing)

- Pet care products

- Toys and accessories

- Clipping and grooming

- Training

- Transport

- Memberships and competitions (if any)

- Walking (dogs)

How do I find suitable pet insurance as a senior?

There are a few factors for seniors to consider when comparing pet insurance policies, because costs can vary depending on the pet’s breed, size, or age.

Pet insurance policies tend to vary in levels of cover and could include cover for scenarios including specified accidental injury, illnesses and the related medical procedures.

Some comprehensive policies also offer optional benefits, such as routine care cover. You may also wish to consider policies that include extras such as emergency boarding in the event that you are hospitalised.

The important thing is to find a suitable policy for you and your pet.

Are there any specific pet insurance policies designed for seniors?

Keep in mind when we say seniors, we’re talking about older owners, not older pets! Generally pet insurance products tailored to (or only available for) senior owners are pretty similar to other products but they can sometimes include additional features or benefits more relevant to older owners. These features can include things like discounts for senior owners (i.e. 50+) or services like in-home vet visits for older owners who may find it more difficult to leave the house to visit a vet.

Is pet insurance just another cost for seniors?

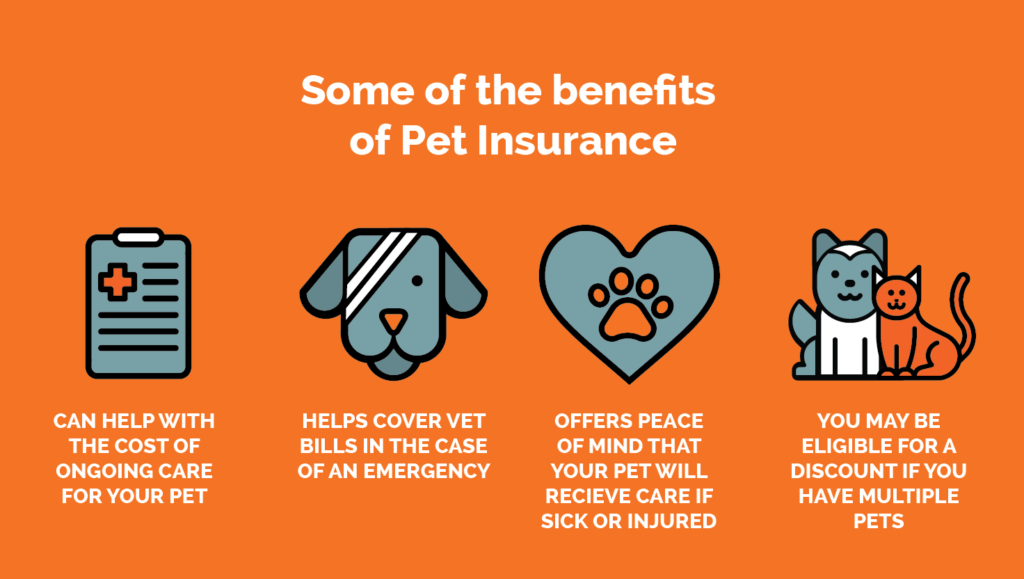

As a senior, you’re possibly already careful with how and where you spend your money. Pet insurance may seem like just another cost, but it can help you cover expensive eligible vet bills for your pet, as well as give you peace of mind.

A typical example could be a case where your pet may need urgent medical attention and care, but the cost of the treatment could be expensive and cause you to feel stressed. This would be on top of already worrying about the health and wellbeing of your pet!

Pet insurance could help alleviate some of this stress, and depending on the policy chosen and the level of cover, you may be able to sleep a little easier at night knowing that your pet is able to get the treatment they need.

What is the cost for pet insurance?

Cost depends on the provider and will be determined by factors such as the breed and age of your pet, the level of cover you choose and any optional benefits you may add. Some providers may offer seniors’ discounts, and if you have multiple pets, then you could also be eligible for a multi pet discount.

You could also find policies with options where you can pay the annual premium in smaller monthly instalments to reduce the impact of any sudden financial burdens.

How does the claims process typically work?

Generally speaking, insurers have a waiting period from the time you sign up, so make sure you ask them how long the waiting period lasts before you can make an eligible claim.

It’s also worth keeping any vet bills so that you can scan them or take a photo of them to submit when you make a claim.

Making a claim is typically a straightforward process, as you’ll probably be able to download a form from your insurer’s website. You may also be able to lodge the claim with your insurer via phone.

As long as your claim is covered by your policy, a percentage of your costs could be met. However, this will depend on your policy, and the specific circumstances surrounding the claim.

How do I choose a policy?

Comparing pet insurance policies can be overwhelming, which is why at iSelect, we’ve partnered with Choosi to make the task of comparing a range of policies side by side easier for you. You can start by comparing online with our free comparison service, or by giving us a call on 13 19 20.

Last Updated: 16/08/2022

Easily compare Pet Insurance quotes

Select cover for your pet from a range of brands through Choosi.*

*iSelect’s partnered with Choosi Pty Ltd (ABN 15 147 630 886) to help you compare pet insurance policies. iSelect earns a commission from Choosi for every policy sold through the website or contact centre. iSelect and Choosi do not compare all providers or policies in the market.

Any advice provided by iSelect on this website is of a general nature and does not take into account your objectives, financial situation or needs. You need to consider the appropriateness of any information or general advice we give you, having regard to your personal situation, before acting on our advice or purchasing any policy. You should consider iSelect’s Financial Services Guide which provides information about our services and your rights as a client of iSelect. iSelect receives commission for each policy sold by Choosi.

.svg)