How Much Money Should I Have In Savings?

Francis Taylor

Last Updated: 19th October 2022

Some of us have a little and some of us have a lot. There’s no clear answer to how much money you should have in savings, because it all depends on a few different factors like your age, income, existing debts, and long-term goals.

What are the average Australian household spending habits?

Data from the Australian Bureau of Statistics shows that from March to June 2020, the average Australian household saving to income ratio increased to 19.8%, up from 6% in the December 2019 to March 2020 quarter. 1 If this rapid increase shows anything, it’s that the pandemic and ongoing lockdowns significantly impacted both our ability and desire to spend money.

The ABS findings further showed that the household saving to income ratio rose to the highest level since 1974, because of the drastic drop in consumption rates as a result of the COVID-19 pandemic2.

But it’s likely Australians’ spending habits are once again climbing up as we slowly move into a COVID-normal. So to fight off the impulse to start spending big, think about the 50-30-20 rule before your next purchase.

Saving with the 50-30-20 rule

Considering the 50-30-20 rule3 could be a useful tool when you start thinking about budgeting and how much money you could have in your savings account.

As we explored in our article on budgeting, the rule provides a framework for how to more effectively distribute our spending. So, 50% is for necessities, 30% is for wants, and 20% is for adding to your savings and investments.

Start by checking your bank statements and account balances and study your spending for the past three months. Label each deduction from your account as either a necessity, want, or investment. Since you’ll have a good overview of your spending habits over the past three months, you can also use this data to predict your spending over the coming three months, and possibly reprioritise if need be.

How much money can Australians realistically save?

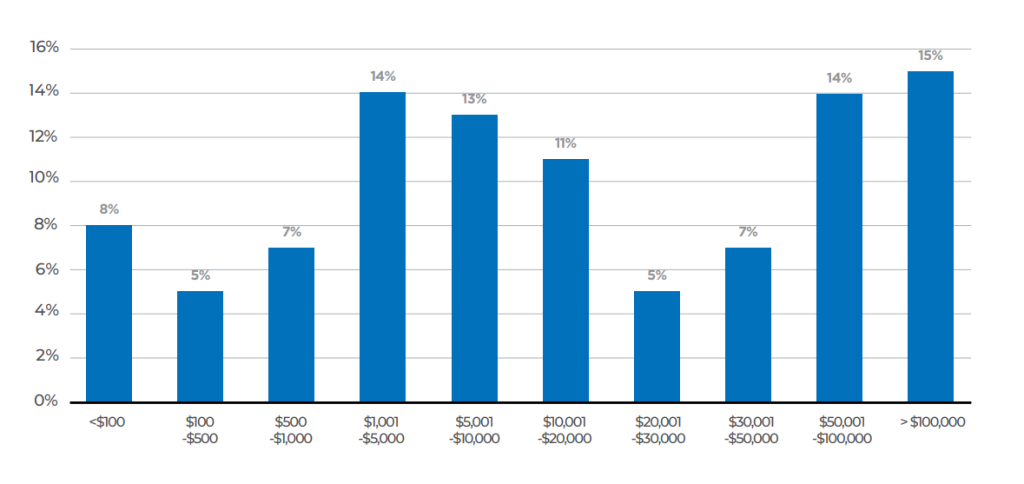

Findings published in the July 2020 ME Household Financial Comfort Report showed that out of the surveyed 1,500 Australian households, 21% of them had savings of less than $1,0004. A further 14% of those households had savings between $1,001 to $5,000 while a similar amount of households had between $5,001 to $10,000. Over 30% of households have over $50,000 in savings5.

How much in case savings does your household currently hold – including savings accounts, term deposits and offset accounts?

Source: ME Bank Household financial comfort report 2020 (page 29).

As you can see from the ME survey, the results are quite varied, with a tendency for Australian households to have either a little or a lot in savings.

The Reserve Bank of Australia has reported extensively on trends in household spending, and their findings show that on average, household saving ratios tend to increase with income, while saving is found to decrease with wealth and gearing.’6

In addition to those findings, ‘financially constrained households and households deemed to be at risk of a future income shock tend to save more than other households.’7

So while it isn’t realistic for everyone to put money away for a rainy day, if you are able to do so, a good general guideline could be to gradually set aside money into your savings account, bit by bit.

What are some strategies Australians use to build their savings?

There’s no one-size-fits-all approach when it comes to building up your savings, as what works for one person might not work for another. That being said, most households do share some common expenses, and in some cases it may be possible to decrease their cost.

One such expense is debt – which can include what you owe on a home loan, credit card or personal loan. Since a portion of your income always needs to pay off these debts, the more debt you have the less you’ll generally be able to save.

In contrast, households can free up their ability to save by reducing their debts. For instance, they may be able to refinance their home loan to one that offers a lower interest rate and reduced monthly repayments.

Some lenders also offer personal loans which people can use to consolidate their credit cards and other debts. As with the previous example, this may allow them to pay off these debts at a lower interest rate.

Of course, finding a suitable product for debt consolidation or refinancing requires careful research. And this often involves comparing different options between lenders.

Fortunately, iSelect can help here. With us, you can compare home loans, personal loans and credit cards from a range of lenders, making the whole process a lot easier.

What other expenses can impact your savings?

Household bills and financial products (such as insurance) can also affect how much people are able to save – especially if they are paying more than what’s necessary. For this reason, you may want to review the following expenses:

Car insurance

If you hold car insurance, then you might want to check if you’re eligible for any discounts with your provider. For example, you may be eligible for a “no claims” bonus if you haven’t lodged an insurance claim for a certain period.

Furthermore, by comparing car insurance products you may be able to find one at a lower premium than you already pay. And with iSelect, you can compare policies with some of Australia’s leading car insurers online.

If you hold car insurance, then you might want to check if you’re eligible for any discounts with your provider. For example, you may be eligible for a “no claims” bonus if you haven’t lodged an insurance claim for a certain period.

Health insurance

According to the Australian Government Department of Health, about 13.6 million Australians hold private health insurance8. However, they also note that ‘many people don’t fully understand what they are getting for their money and what they are covered for’.

Therefore, it may be worthwhile to review your health insurance policy. Keeping abreast of the extras attached to your cover, as well as your excess (which is your out-of-pocket payment required when you make a claim), can help you understand if your policy suits your needs.

Your insurer may also allow you to increase your excess and/or reduce your extras limits, which could possibly lower the premium you pay. Alternatively, if you’re looking to find a better value policy, you can compare a range of health insurance options with iSelect.

Life insurance

Life insurance and related forms of cover, like income protection, total permanent and disability (TPD) insurance and trauma (or ‘critical illness’) insurance, can pose a significant expense for many Australians.

But as with other insurance products, there’s a range of different providers offering different cover options. While so many options can be overwhelming, with our partner Lifebroker, you can compare policies from several leading life insurers within Australia.

Pet insurance

A 2021 report from Animal Medicines Australia notes that only 24% of dog owners and 19% of cat owners pay for pet insurance9. It’s also estimated that the average pet-owning household spends $245 a year on insurance for dogs and $116 on insurance for cats – although this estimate includes households who don’t hold any cover10.

As such, you might wish to compare different pet insurance policies to find more cost-efficient cover. And at iSelect, we’ve partnered with Choosi to help you compare products from a range of providers.

Home & Contents Insurance

For many households, home & contents insurance represents a safety net of sorts. It provides cover that could possibly compensate if your home is damaged, or if any furniture, jewellery or household items are lost or stolen.

Obviously, such cover does not come free of charge. But iSelect also offers an online tool that you can use to compare these policies from a range of providers.

Electricity & Gas

Utility bills can often put a strain on household finances – and over the last few months that strain has only gotten more pronounced.

According to the Australian Energy Regulator, the wholesale cost of gas and electricity has increased sharply over the first quarter of 202211. And this will likely translate to higher prices for ordinary Australians.

Because of this, it may be worth comparing the conditions and prices of different energy plans. Again, iSelect can help with this: and you can compare plans with us from a range of energy providers online.

Internet expenses

Many Australians rely on stable internet access for work and recreation, but as with mobile phones, the cost of a regular internet plan can quickly accumulate.

However, choosing a suitable plan may help to keep costs at a reasonable level. For instance, someone who never exceeds their monthly data allowance could save by opting for a cheaper plan with a lower data allowance whereas if you are regularly running out of data, you might be better off going with an unlimited data plan

If you’re interested in comparing different internet plans, iSelect can help as well. With our online tool, you can compare plans from a range of different providers today.*

Of course, with the above examples just keep in mind that a cheaper plan or product isn’t necessarily better. And what’s most suitable for you will ultimately depend on your particular needs and circumstances.

How else can you boost your savings?

Ultimately, everyone’s needs are different, so it’s up to you to figure out how much money in your savings account would give you breathing space and peace of mind.

And even if you can’t set much money aside, it might help if you shift your perspective and think of every little contribution as a safeguard to protect you against emergencies or unexpected surprises.

To help get your savings started see how much you could save by comparing a range of insurance and utilities products online with iSelect*.

2 Source: as above

3 Source: https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp

5 Source: as above (page 29)

6 Source:https://www.rba.gov.au/publications/bulletin/2014/jun/pdf/bu-0614-1.pdf (page 7)

7 Source: as above (page 7)

8 Source: https://www.health.gov.au/health-topics/private-health-insurance/private-health-insurance-reforms

10 Source: as above (page 24)

11 Source: Wholesale statistics | Australian Energy Regulator (aer.gov.au)

Francis Taylor

Content Writer

Articles that might interest you

Budgeting & Saving

VIEW ALL

How to Save For a House Deposit In 2022

BY Francis Taylor | 19th September 2022

How on earth are you supposed to save up for a home? This is a question on the lips of many Australians – especially ...

How Much Of My Income Should I Be Saving?

BY Francis Taylor | 19th September 2022

There’s no one-size-fits-all approach to saving. Since ev...

What Is Inflation & Why Does It Matter?

BY Francis Taylor | 19th September 2022

Let’s face it – when it comes to the economy, things coul...

How to Create a Family Budget

BY Francis Taylor | 19th September 2022

Are you and your partner looking to start a family? Or pe...