iSelect does not compare all providers or policies in the market and not all policies or special offers are available at all times, through all channels or in all areas. Not all policies available from our providers are compared by iSelect and due to commercial arrangements and customer circumstances, not all policies compared by iSelect are available to all customers. Learn more.

Car Insurance for seniors

It might not be too often that you think having silver hair has a silver lining, but if you’re over 50 with a good driving history, you may find more competitive car insurance rates compared to some younger drivers.

Why might Car Insurance be cheaper for seniors?

Insurers may offer Car Insurance to seniors at a cheaper premium because seniors tend to be lower-risk and safer drivers. The age at which you’re classified as a senior varies across insurance companies but is typically at 50 or 60 years old.

How could seniors save on their Car Insurance policies?

No claims discount

Hopefully over the years you’ll have accrued a maximum no claims discount, the exact discount can vary between insurers, so check it out.

Listed drivers

Be aware that listing young drivers on your policy can bump up your premium with some insurers. You could save by restricting your policy to drivers to over a certain age.

Garage your car

A car which is securely garaged at night is safer from theft and other damage, so may attract a lower car insurance premium.

Low mileage

If you’re driving less, you could be paying less. Check out low mileage or ‘pay as you drive’ style policies.

Helpful Tip:

A small change in your circumstances could make a big difference to how much you pay – plus you can check if you’re eligible for any discounts. So, speak to your insurer and ask them if you can add any low-kilometre or age-based discounts to your policy. And if not, it’s time to switch!

How much is Car Insurance for seniors?

You can use our interactive chart to find out the average car insurance premium for iSelect customers over 60. Take a look at the price for each state and see how yours compares.

Frequently Asked Questions

What different types of Car Insurance are available for seniors?

No matter your age, experience, or driving history, you’ll generally still have access to the same four types of insurance policy as all drivers. Here’s a quick refresher on what each covers.

| Car Insurance type | Damage to your car | Damage or loss caused by theft | Damage to another person’s car or property | Injuries or death to others in an accident |

| Compulsory Third Party (CTP) | No | No | No | Yes |

| Third Party Property | No | No | Yes | No (but covered by CTP) |

| Third Party Fire and Theft | No | Yes | Yes | No (but covered by CTP) |

| Comprehensive | Yes | Yes | Yes | No (but covered by CTP) |

Compulsory Third Party Insurance (CTP)

CTP is mandatory insurance for every driver in Australia and in some states it’s paid automatically whenever you register your car. It helps cover accidental injury or death to another person caused by your driving.

Third Party Property Damage (TPP)

The next is TPP Insurance. As the name suggests, this helps cover damage to other people’s vehicles and property caused by an accident that was your fault. It generally doesn’t cover damages to your car or property though. If you take this insurance out, you would be responsible for the costs of replacing or repairing your own car in the event of an accident.

Third Party Fire and Theft (TPF&T)

TPF&T Insurance helps cover third party property damage as above, but also includes damage to your car because of fire or theft. Remember, this option still doesn’t cover damage caused to your car in an at-fault accident or for most possible incidents.

Comprehensive

The highest cover available is Comprehensive Car Insurance. Whether an accident is your fault or not, a comprehensive policy can help cover damage to other people’s property and vehicles, as well as your own.

In many cases, it may also cover events like hail or storm damage. A Comprehensive policy often comes with options to add extras to your cover, like a hire car or Roadside Assistance and Personal Effects Cover. These options vary between providers and some may be covered in the original premium, so it’s always worth checking out.

What are the licensing requirements for senior drivers?

As a senior driver, you’ll likely face licensing restrictions depending on which state you live in. These requirements can also change, so it’s a good idea to check the current laws in your state before taking out car insurance.

We’ve also included a breakdown below of the restrictions by state.

Queensland

QLD has a strict requirement that every driver 75 and over needs to carry a ‘medical certificate for motor vehicle driver’ form whenever they drive. Drivers face fines if they don’t present it when asked.

The form:

- Is in two parts, one for you to complete and one for your doctor.

- Must be completed annually during a medical assessment.

- Is usually valid for 13 months.

- May be valid for a shorter time when medical conditions need regular reviewing.

New South Wales

In NSW, the following regulations apply:

- Drivers 75 and over must have a medical assessment every year

- Drivers 85 and over must also take a practical driving test every two years to keep an unrestricted licence

- Drivers 85 and over can opt for a modified licence to avoid having to take the practical test

Australian Capital Territory

In the ACT, drivers 75 and over must have an annual medical assessment. Drivers must legally report any medical condition that may affect their driving.

Victoria

While there is no requirement for senior drivers to pass regular medical assessments in Victoria, you must legally tell VicRoads about any conditions that could affect your driving as soon as possible. You may then be required to attend regular medical assessments.

Tasmania

The Tasmanian government has minimal rules in place for senior drivers:

- 65+ drivers can only renew their licence when it expires and have the renewal fee waived with only a smaller card fee applied.

- Senior drivers are encouraged to self-assess their driving and make sensible choices. Friends and family are also encouraged to confidentially notify Tasmania’s Transport Services if they have concerns about someone’s fitness to drive.

South Australia

Seniors in South Australia are not required to pass an annual medical test, unless they have a known medical condition that needs to be regularly assessed.

Instead, drivers 75 and over must complete a self-assessment form every year. If they answer yes to any questions, they must complete the assessment with a doctor. Senior drivers must only take a practical driving test if recommended to do so by a doctor.

Western Australia

In WA, senior drivers over 80 must:

- Pass a medical test every year

- Take a practical driving assessment if there is any concern about their ability to drive

Drivers 85 years or over will also need to take the practical driving assessment every year.

Northern Territory

In the NT, drivers are expected to self-assess their driving ability.

However, a health professional registered with the Australian Health Practitioner Regulation Agency is legally required to tell the Motor Vehicle Registry (MVR) if they have assessed someone as unfit to drive.

What is the best Car Insurance for seniors?

Different people have different needs. A car insurance policy that works for someone else might not necessarily work for you. This is why no one policy can reasonably be called ‘the best’ for seniors or pensioners.

Often there can be a trade off between the cost of the policy and the coverage it provides, including optional extras. The right balance can depend on your budget, your personal circumstances and the level of risk you want to protect yourself against.

Are any discounts available for seniors?

Some policies offer discounts for drivers who meet certain conditions. Depending on your policy, you might be eligible for any of the following discounts below.

No Claims Discount

This is essentially a reward for safe drivers. If you haven’t made a claim in a long time, then insurers will likely see you as a low-risk driver, and they might be willing to reduce your premium as a result.

It usually only applies to Comprehensive car insurance policies and is calculated based on the following:

- How long you (and any other drivers on your policy) have been driving

- Your claims history, including claims made by other drivers on the policy

- The rating your previous car insurer gave you

The discount typically increases every year that you hold onto your policy and don’t make a claim (up to a maximum of five years).

Multi-policy Discount

Do you already have a health or contents insurance policy with an insurer? Or maybe you already have Compulsory Third Party Insurance (CTP) with your insurer and you’re looking to get Comprehensive cover as well? You might be eligible for a multi-policy discount.

Not all insurers offer a discount for holding multiple policies, but it’s still worth asking if such discounts are available. Even if you can’t get a discount on your car insurance, you might still be able to get a discount on one of the other insurance policies you hold.

Online Discount

In the digital age, it pays to do your business online. Many insurers offer a noticeable discount for customers who purchase their policy online. Usually, this will be front-and-centre on their website—often on the car insurance product page—if the insurer offers the discount.

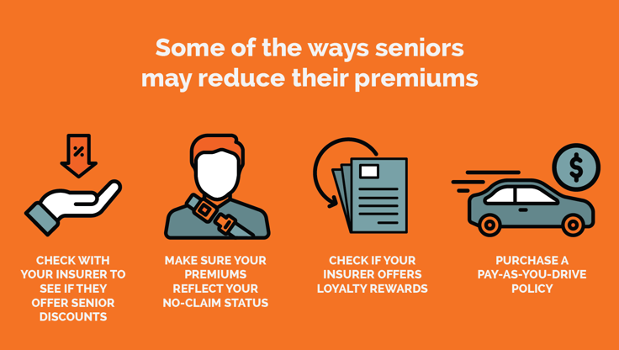

How else can seniors reduce their premiums?

Taking advantage of discounts isn’t the only way to save. There are a number of features on your policy you might be able to adjust, or actions you can take, to keep your insurance premiums low.

Adjust your excess

Your ‘excess’ is how much you’ll end up paying out-of-pocket when you make a claim. A higher excess means the insurer ends up paying less, and because this reduces their risk, it usually translates into lower premiums. Just keep in mind what you’re willing to pay when selecting an excess—it’s always prudent to settle on something you’re confident that you can afford.

Pay annual premiums

Paying your premium in annual instalments instead of monthly ones is usually cheaper overall.

Keep your car safe

If your car is equipped with a security device, like an alarm or GPS tracking device, or if you keep your car parked overnight in a secure garage (instead of on the street), then your insurer might be willing to reduce your premiums.

Consider market value cover

With Comprehensive Car Insurance, there’s two ‘value types’ you can choose from: agreed and market value. With agreed value cover, you’ll receive a fixed sum for your claim if your car is ever written off or stolen. On the other hand, market value cover is generally cheaper, but it will only cover you for the price of your car on the market at the time of the claim.

Low Kilometre Policies

Drivers who don’t use their car all that much might also be regarded as a low risk for insurers. You might be able to reduce your premium if you only drive a limited number of kilometres, but this is something you’ll usually have to discuss with your insurer.

Alternatively, some insurers will offer specific, lower premium policies for drivers with low mileage. Budget Direct, for example, offers a ‘Gold Low Kilometres Comprehensive policy’ for people who drive less than 10,000km per year.

Restricting Drivers

Some insurers will also offer a lower premium if you restrict your policy to drivers of a certain age. For instance, the insurers at Retirease can reduce your premium if nobody under 25 drives your car.

This is because young drivers are statistically more likely to get involved in road accidents, so a policy that omits such drivers is going to pose a much lower risk for insurers.

How does age affect my premium?

Insurers calculate premiums based on risk.1Moneysmart – Choosing car insurance And, because older drivers tend to be over-represented in road accidents (much like younger drivers), they may attract higher premiums as a result.2Transport Accident Commission – Older people

However, age is not the only factor used to calculate premiums. You may be able to delay premium increases if you have a safe driving record and maintain good health. It’s also a good idea to review your car insurance to make sure your premiums aren’t unnecessarily high. You may not be receiving all the benefits you could be, or you may find that another insurer offers a better deal.

Sources:

1. Moneysmart – Choosing car insurance

2. Transport Accident Commission – Older people

What is ‘pay as you drive’ insurance?

A ‘pay as you drive’ policy bases your premiums on how much—or how little—you drive. Depending on your insurer, you might be able to designate how many kilometres you plan to travel each year and receive a quote based on this amount.

These policies may be especially suitable for people who don’t drive all that much. However, you might want to ask your insurer if the kilometre limits are adjustable—just in case you ever go over them.

Can Car insurance cover my medical expenses if I’m injured?

If you get into a car accident with another driver where they are the ones at fault, then their Compulsory Third Party Insurance (CTP) will cover the medical expenses for your injuries.

It is also mandatory for every registered vehicle in Australia to hold some form of CTP cover.

If you are at fault for the accident, or if nobody is at fault, then your car insurance policy is unlikely to cover your medical expenses. Car insurance policies either cover damage done to another driver’s car, person or property, or your car. They are not intended to cover the policy holder’s medical expenses.

In these situations, you will either need to rely on the public health system to treat you, or a private health insurance policy to cover your medical expenses.

iSelect does not compare all car insurers or policies in the market. The availability of policies may change from time to time. Not all policies available from iSelect’s providers are compared by iSelect and due to commercial arrangements, area or availability, not all policies compared by iSelect will be available to all customers. Some policies are available only from iSelect’s call centre or website. A number of our participating general insurance brands are arranged by Auto & General Services Pty Ltd ACN 003 617 909 on behalf of Auto & General Insurance Company Limited 111 586 353, both of which are related entities of iSelect Limited. Our relationship with those companies does not impact the integrity of our comparison service. Click here to view iSelect’s range of providers.

iSelect General Pty Limited ABN 90 131 798 126, AFS Licence Number: 334115. Any advice provided by iSelect is of a general nature and does not take into account your objectives, financial situation or needs. You need to consider the appropriateness of any information or general advice iSelect gives you, having regard to your personal situation, before acting on iSelect’s advice or purchasing any policy. You should consider iSelect’s Financial Services Guide which provides information about our services and your rights as a client of iSelect. iSelect receives commission for each policy sold that is a percentage of the premium or a flat fee. Ask us for more details before we provide you with any services.

.svg)