IT Contractor Insurance

IT Contractor Insurance

*iSelect’s partnered with BizCover Pty Ltd to compare a range of small business insurers and policies in the market. Not all policies are available at all times or in all areas. Our advice on this website is general in nature and does not consider your situation or needs. Consider if any advice is appropriate for you before acting on it. Learn more.

Compare business insurance the easy way

We’ve partnered with BizCover to help you compare business insurance policies.*

What is IT contractor insurance?

What business insurance products can be relevant for IT contractors and consultants?

Compare IT consultant and contractor insurance with iSelect and BizCover

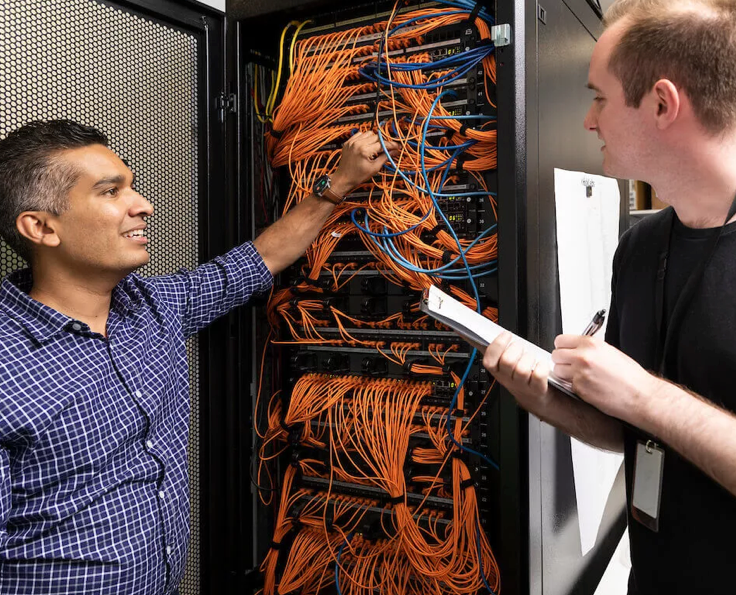

If you’re an IT contractor or consultant, there’s a chance you are exposed to sensitive data and information. When working with a company, it’s important to understand the risks associated with that exposure, such as cyber attack or equipment damage.

What is IT contractor insurance?

There is no specific “IT Contractor insurance” product, however there are a number of different policies which may be relevant to an IT contractor. These policies can provide varying levels of protection if you’re sued for damages by a third party.

What business insurance products can be relevant for IT contractors and consultants?

Below are various business insurance products and policies which may be relevant to IT consultants and contractors.

Professional indemnity insurance:

Professional Indemnity (PI) insurance* can be an important form of protection for businesses that provide specialist services or professional advice, such as IT contractors and consultants. It is designed to respond to claims against your business for losses as a result of actual or alleged negligent acts or omissions in the provision of your professional service or advice. PI Insurance may also assist with the legal costs associated with responding to or managing claims which are covered by the policy.

For example, if a client alleges they suffered financial loss as a direct result of negligent IT advice you provided, PI insurance may help meet some of the associated compensation payable to the third party together with your defence costs (which can include legal costs, investigator costs and expert fees).

Cyber liability insurance:

If you’re handling sensitive customer data or private client information in the scope of your IT work, then you may want to consider Cyber Liability insurance.

Cyber Liability insurance is designed to help protect you from claims and support your profitability in the event of a cyber breach or attack. Some of the costs associated with defending a cyber claim can also be covered. Examples of the types of risks Cyber Liability insurance may assist with are inadvertent loss or release of a customer’s personal information, cyber crime, cyber extortion/ransomware and business interruption due to a cyber event.

Electronic equipment:

Electronic equipment insurance* helps cover the cost to repair or replace specified electronic equipment following a breakdown. You can usually also choose to insure some of the additional costs to your business or business interruption expenses caused by a breakdown of electronic equipment.

In your IT business this could include computers, smartphones, servers and/or data storage units.

Business interruption

Business interruption insurance* helps provide cover for the loss of income and increased costs of operating your business caused by a specified insured event (such as property damage or fire). It is also designed to assist your business to recover from an insured event by paying some of the ongoing expenses (such as wages or rent).

Compare IT consultant and contractor insurance with iSelect and BizCover

iSelect have partnered with BizCover to help you find a business insurance policy. Compare policies from our range of providers online today, or call our friendly team on 13 19 20.

*As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording.

.svg)